In Parts 1 and 2 we presented the lucrative and anonymous tax haven provided by New Zealand Foreign Trusts. We showed that when these trusts were legally introduced into New Zealand, Frank ‘the Bank’ Renouf returned from post-war Germany and established New Zealand’s first merchant bank and introduced ‘unit trusts’ to this remote Pacific nation. Renouf’s last wife revealed that her late husband had a close relationship with the number-one commercial banker during the Nazi-era; that man was Hermann Abs. Not only did she claim that Frank Renouf and Hermann Abs were buddies, but that Abs was hand-picked by the Jewish banker-turned British Spy, Robi Mendelssohn. Abs went on to allocate Marshall Plan funds and economically re-construct West Germany.

As Hermann’s powerful reach took control of post-war Germany, Frank Renouf was making an eye-watering fortune in far-away New Zealand. The Americans began to smell a rat. They did not focus on these two men in particular, but on a hidden “Deep State” embedded within their own nation. The American people were demanding transparency, and Frank Church stepped up to the plate:

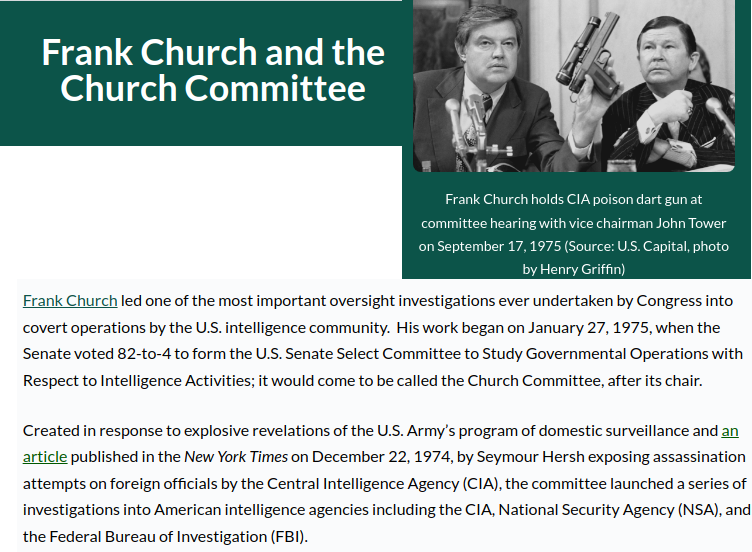

In Part 2, we revealed a declassified confidential memorandum that was supplied to Senator Church in respect to his investigations:

The document goes on to describe how Foreign Trusts were a key part of this invisible enemy’s infrastructure:

“HAD RECEIVED MONEY IN CONNECTION WITH THE SALE…………THE PATTERN INCLUDED PAYMENT OF A NOMINAL COMMISSION IN GERMANY WITH THE BALANCE TO CONCEALED FOREIGN ACCOUNTS”

It went on to state:

“AS THE FMOD HAD NO SPECIFICS AND NO POWER TO GET FOREIGN RECORDS WITHOUT SPECIFICS NOTHING FURTHER COULD BE DONE”

How was it that America, the nation which dominated both World Wars, established itself as a world superpower, enjoying worldwide military and economic dominance, was unable to do anything further when it came to these “concealed foreign accounts”?

Please take time to contemplate that 20 years earlier it was Hermann Abs who was entrusted with the distribution of $13 billion American taxpayer dollars to rebuild Germany. Now that he had been caught accepting dark money, would this not have sparked such an outrage that there would be an immediate investigation and an audit as to what happened to EVERY SINGLE PENNY of the Marshall Plan funds?

If this is making your blood boil, we suggest you take a moment to calm down. Why? Because we are about to present the final piece to this bizarre puzzle, and if your blood is already boiling, you may well vaporize as you read this next instalment.

Fractional Reserve Madness

This story begins with the founding of the US Federal Reserve in 1913. In Prussian Origins of the U.S. Federal Reichsbank, we outlined how this institution came to be. What’s most important to note in this article, was that the architect was Prussian banker, Paul Warburg:

https://truthtrench.org/?p=3655

In the Not Since 1917 series, we showed that through the War Finance Corporation and the Federal Reserve, of which Paul Warburg was Vice Chairmen at the time, America was flooded with debt and newly printed money:

This was a serious chunk of cash back in the 1920s. In 1924, WWI was becoming a distant memory, and with all this new money in the system, the American economy appeared to be on the cusp of a spectacular boom.

Where did most of this new money find a home? In the New York Stock Exchange.

We will address the Great Crash shortly, but the extraordinary rise of the stock market throughout the roaring 20s was facilitated by a new financial product provided to the average punter; this was known as margin lending.

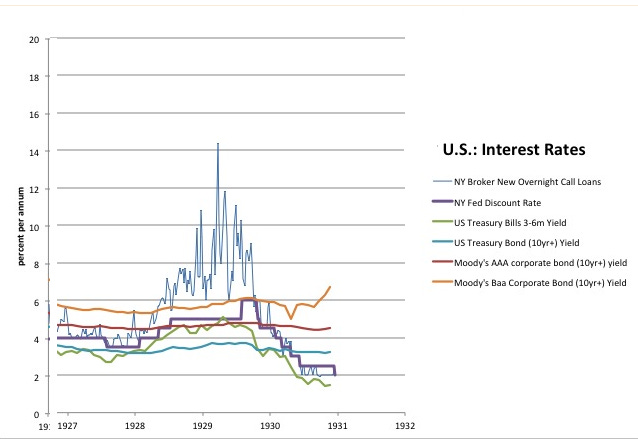

Who was providing these loans to the stock gamblers? There were approximately 25,000 banks in America at the time, and as the demand for margin-loans increased, so did the interest rate attached to them. Banks began to lure depositors in by offering higher and higher rates of return. They would then lend the depositors money to brokers in New York, making substantial profit in the process. At its peak, interest on overnight margin loans reached a whopping 14%!

The Federal Reserve knew they had created a monster, and began to panic. The money and credit that had been injected into America since 1917 was piling into the biggest speculative bubble in history. The Fed of San Francisco summed up the entire mess:

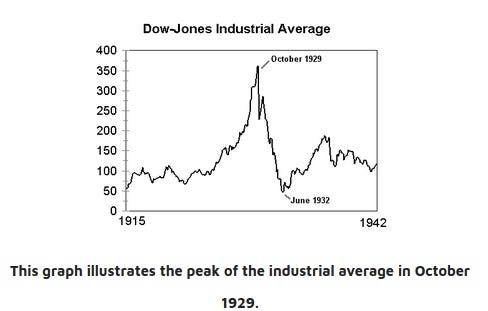

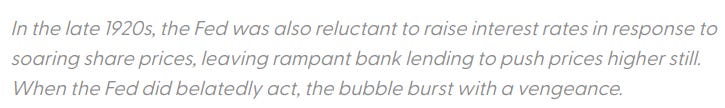

Over the next three years, the Dow Jones dropped nearly 90% from its 1929 highs. However, the real pain would come after the crash. The banks who had deployed their depositor’s money into New York Stock Exchange margin loans, had been wiped out. The collateral for these loans were the stocks, but these had dropped in value by 90%+. The banks had been vaporized, along with the savings of their customers:

The disappearance of so many banks began to affect real businesses, who could no longer get loans to facilitate their operations. Businesses across America, and the world, failed spectacularly. Unemployment skyrocketed; poverty and famine followed. The world plunged into the Great Depression.

FDR, Government Intervention and Unintended Consequences

With the Great Depression in full swing, the President of the United States, Franklin Delano Roosevelt, was voted into office to fix the problem. He was effectively given a mandate to ‘do something’, and he was not going to disappoint.

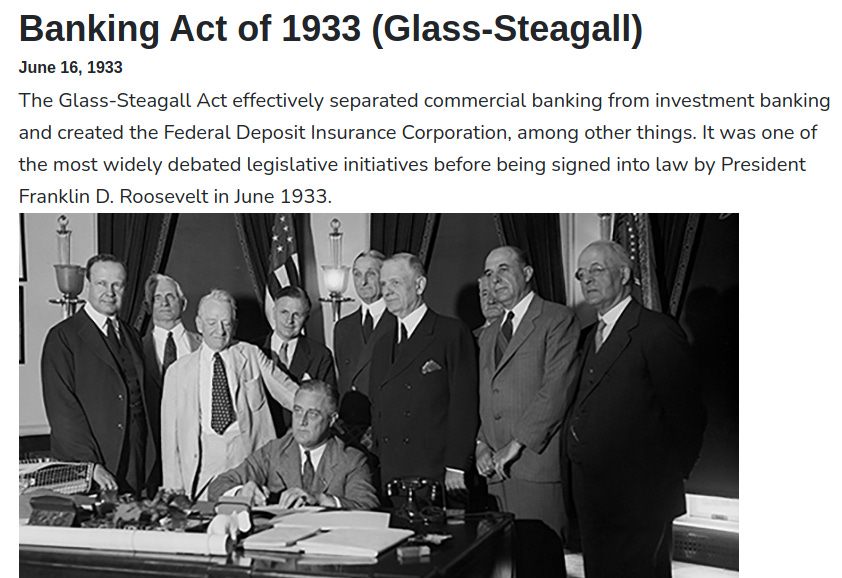

Some people had lost their life-savings in the Great Crash. Tragically, many had not even bought stocks; they had simply deposited their money into a bank that ‘invested’ their deposits into these failed stock market margin-loans. American’s faith in the banking system had been shattered, and the FDR administration believed their primary mission was to restore confidence in banks. The speculative loans that the banks had made to these margin-lending business had to be stopped. Senator Carter Glass was called to action.

In 1913, Carter Glass was a congressman, and was instrumental in drafting the Federal Reserve Act:

In 1933, Glass addressed the disaster of the 1929 crash, and brought yet another Act to the Congress:

Coupled with the Glass-Steagall Act was a lesser known regulation.

Regulation Q.

The reforms of the day resulted in a change to the Federal Reserve Board Regulation:

Regulation Q effectively banned banks from trying to lure investors in with excessive interest rates, so they could then speculate with the deposit. These reforms aimed to return banks to their original business plans; banking.

American banks were now heavily regulated, and in return the government would insure those deposits through the Federal Deposit Insurance Corporation (FDIC). It was an intervention that may have initially solved a problem, but the story was far from over:

The Marshall-Plan and the Birth of the Eurodollar

As we presented in Part 2, the Marshall Plan was a monumental investment made by the American taxpayer into war-torn Europe. The man responsible for the allocation of those billions of US Dollars, was Hermann Abs.

As Western Europe recovered from the economic abyss, they began running large trade surpluses with the US. Coupled with the billions of US dollars flowing via the Marshall Plan, Europe was rapidly being flooded with American dollars. These “off-shore dollars” became known as “Eurodollars”:

(NOTE: Eurodollars are NOT Euros. They are simply US dollars that are not located in America; think of them as US dollars abroad. This is important to remember as we progress through the story.)

While there was nothing particularly new about USD being held by foreign banks, the tsunami of dollars from the Marshall Plan and onwards, led to the Eurodollar becoming a major currency held off-shore. There was also one significant aspect to these Eurodollars that requires careful consideration:

“One of the main advantages of the Eurodollar market is that it allows for the bypassing of domestic regulations and taxes, making it attractive to borrowers and lenders who want to avoid these costs. However, this also means that the Eurodollar market is less regulated and transparent than domestic financial markets, which can increase the risk of financial instability.”

The significance of this detail cannot be overstated. Eurodollars are US dollars, sitting outside of the US, however they are free from American regulations and taxes. Reconcile this with the Church Committee’s discovery that Hermann Abs had received US dollars from Lockheed and that the funds were “concealed in foreign accounts” and “nothing further could be done”.

In other words, Eurodollar holders get to enjoy all the purchasing power of American greenbacks, but are free from American regulation, taxes, and even oversight.

The Church Commission investigation revealed Dutch Prince Bernhard received Eurodollars in the Lockheed bribery scandal. We know Hermann Abs oversaw the distribution of $13 billion in Europe, and was caught taking Eurodollars in the Lockheed investigation.

During the 50s and 60s, guess who else was enjoying the value and purchasing power of American money?

What this implies is simply staggering. The communist dictatorships knew their currencies were worthless, and instead relied on the value of the USD for their global trade.

Eurodollars allowed America’s greatest enemies to use US dollars as a store of value, part of which would be used to attack and infiltrate America and her allies. Since Eurodollars sit outside of US jurisdiction, there was nothing that could be done. The Church Commission memo regarding Hermann Abs and foreign accounts confirm this unbelievable situation to be true.

Perhaps this explains the vast array of tinpot dictators, criminal cartels and corrupt politicians who seem obsessed with being paid in Eurodollars. It may also explain the same crowd’s attraction to New Zealand Foreign Trusts.

It is now evident that an unintended consequence of the Marshall Plan was the birth of the Eurodollar. Unfortunately, this is not where this sordid tale ends; it is where it begins.

Midland – Taking the Q

In the 1950s, when a foreign bank received US Dollars from a customer, they would graciously take them as a deposit. However, there was not really a lot they could do with them. For all intents and purposes, these Eurodollars sat in safety deposit boxes and vaults, normally in Switzerland, and received no interest whatsoever. There were billions of these Eurodollars sitting in vaults around the world.

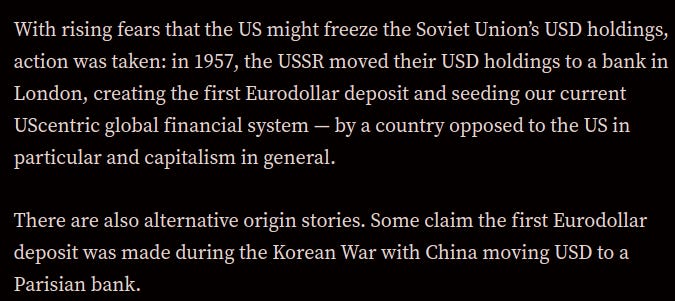

If there’s one thing you can be sure of, where there is unused pools of cash and bankers, the latter will always find a way to put the former to work. In the mid-1950s, British bank, Midland, did exactly that:

In the UK, inflation was on the rise, and therefore so were British interest rates. Eventually, British rates surpassed the ceiling that was placed on USD deposits in American banks:

Midland had worked out an arbitrage. They could borrow US dollars at the very low interest rate that was dictated by Q, and then invest those into British pounds, which attracted a much higher interest rate. Their risks were hedged out in the Foreign Exchange (FX) market, thereby locking in a risk-free profit.

This worked for a while, but eventually the interest rate Midland was willing to pay American banks exceeded the interest rate ceiling placed on them by Regulation Q. Midland immediately discovered a work-around; they would borrow Eurodollars. After all, it is the same product, however this approach would circumvent all those pesky US banking regulations, especially Q.

It was a win-win for Midland. They could continue their arbitrage, and put those lazy Eurodollars to work. The interest returns were greater than would be achieved if they were sitting in an American bank.

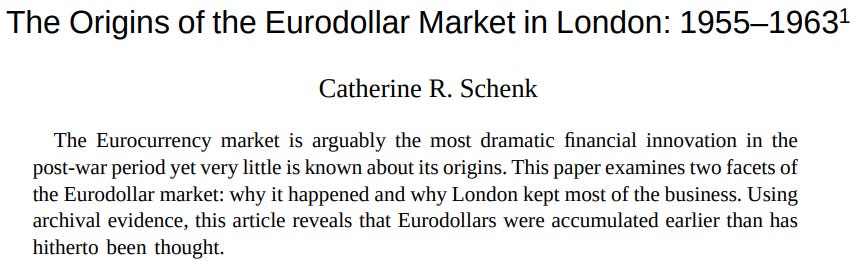

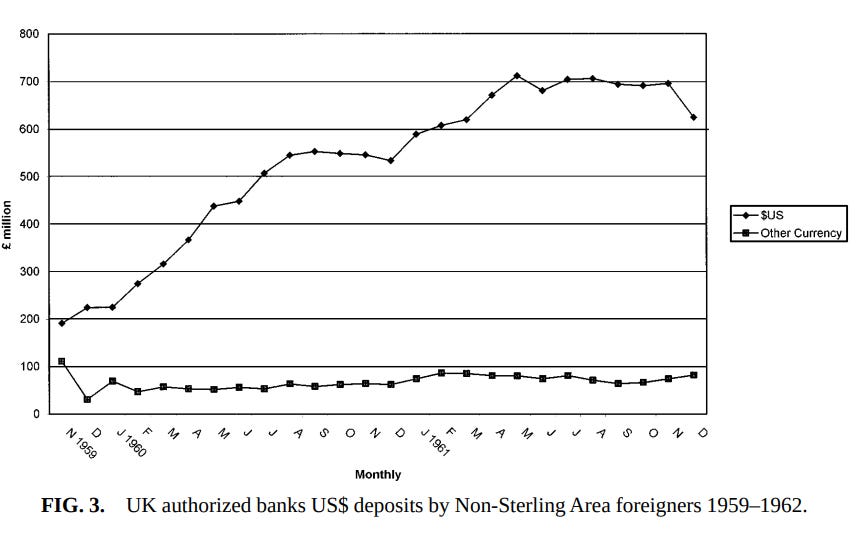

And so began the great flood of Eurodollars into London. The travelling USD, free from any regulation or oversight, could be used to fund any investment product the world had to offer. It is fair to say that it became a popular option in London:

A proper functioning Eurodollar market had been established in London, and Regulation Q had been circumvented. It wasn’t too long before American banks began setting up shop in London to take advantage of the higher interest rates on offer for these off-shore dollars.

With all of these Eurodollars piling up in London, it would take a Warburg to come up with the next cunning plan.

Hermann and Siegmund

As the pool of Eurodollars sitting in London expanded, hungrily seeking returns, the great British arbitrage that Midland had discovered began to narrow and eventually evaporate. However, all the money was still sitting in London, and there was one banker who knew just what to do with it.

As it turns out, this particular Warburg had developed his friendship with Hermann Abs in the 1920s Weimar Germany:

As it seems with all modern Prussians, Siegmund grew up in the Swabian Alps at the castle, “Schloss Uhenfels”. Unsurprisingly, this is only 70 miles from Ravensburg, where Klaus Schwab’s father was running the now infamous Nazi-model factory of Escher-Wyss during WWII. Swabia is also the place where the House of Hohenzollern originated.

Curiously, the castle of Siegmund Warburg’s childhood is now part of a UNESCO “Biosphere”. For those who don’t know, we revealed in An Ode to the Prussian Pickle – Part IV that UNESCO was formed by Julian Huxley after he graduated from the British Psyop-factory known as Tavistock. UNESCO would go on to play a key role in advancing the depopulation agenda. It appears that if there’s not a Prussian directly involved, there’s a Prussian Pickle to ensure the job gets done. You simply can’t make this stuff up!

https://truthtrench.org/?p=3707

One may believe that Paul was the pride of the Warburg family for migrating from Prussia to America and setting up the US Federal Reserve. Or perhaps it was Paul’s brother, Max Warburg, who played a bigger part in history by rising to second-in-command at the German Reichsbank during the early years of Nazi Germany. The competition in the Warburg family was fierce. However, as Siegmund surveyed the vast accomplishments of his family, he turned to his mother and said, “hold my beer!”.

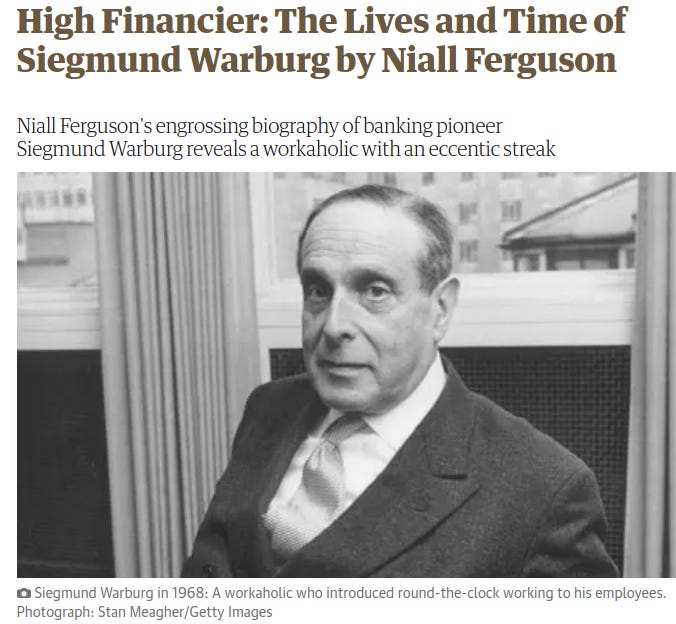

If there is one thing we have learned from globalists, it is that they like to boast of their accomplishments. Siegmend was not one to boast, however there were plenty of other globalists who would do that for him. As a result, we have plenty of information on the career of this very curious character.

One might now be asking, what made Siegmund such a revered banking pioneer?

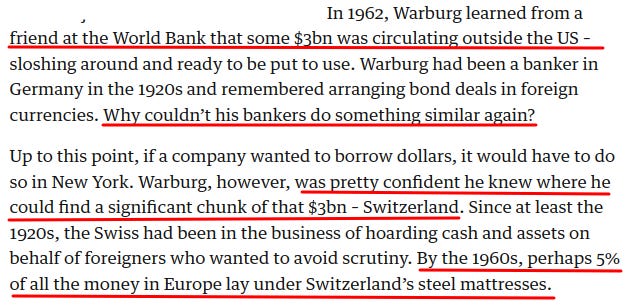

Siegmund Warburg had the good sense to leave the madness of Nazi Germany. He migrated to London and restarted his career in the City of London. By the early 1960s, the secret escapades of the arbitrage discovered by the Midland Bank were already the stuff of legend. City bankers knew there was over a billion Eurodollars sitting in London deposits. However, Siegmund had an edge that no one else had. You see, he was raised in Swabia, which encompasses parts of Germany, Switzerland and Italy. He had access to secrets no one else could dream of:

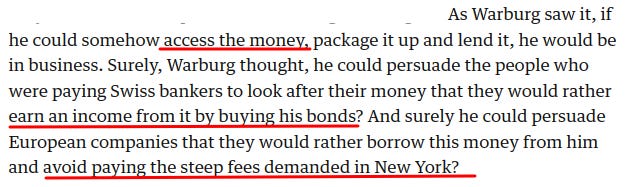

Siegmund’s knowledge of Swiss bank accounts was astounding, especially as Swiss banks were treasured for their vault-like secrecy at the time. His plan was brilliant:

For the most part, the steep fees that were demanded in New York were a result of the regulations imposed upon Wall Street banks, including Regulation Q. If Siegmund could utilize the Eurodollar, he would escape all of those troublesome rules, taxes and fees, and offer an identical product with an even higher interest payout.

Warburg knew he was onto something. In 1962, from his base in London, he and his colleagues packaged up the first ever ‘Eurobond’. Using the billions of Eurodollars sloshing around the world, Eurobonds would change the world forever:

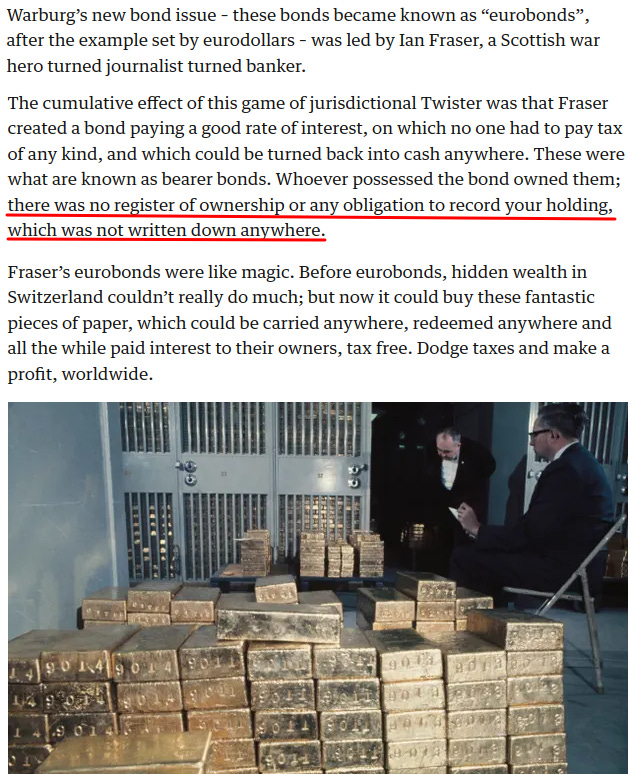

When the first Eurobond was issued, the scale of what had just been unleashed upon the world was known by very few people. Those who understood its potential, immediately took advantage of what was on offer:

When Eurodollars first emerged, after the Marshall Plan, we discovered that the Soviet Union and Communist China were finding ways to keep US dollars hidden from America. When Eurobonds came onto the scene, it is not hard to believe who were the willing buyers of this new financial innovation. They were communist despots, fascist dictators, criminal cartels and corrupt politicians.

This was the significant and powerful investor base that Siegmund Warburg and his banking cartel had tapped into. The magic behind all of this was that Eurobonds, just like Eurodollars, were effectively US dollars, but free from any American regulation. Their value was derived by the ‘full faith and credit of the American taxpayer’. Simply put, the blood, sweat and tears of hard working Americans was supporting the value of an investment product that was attracting some of America’s greatest enemies.

While nobody understood this fact, the Eurobond market could boom without obstruction. More importantly, as long as the Federal Reserve continued to have a monopoly on the issuance of US dollars, the Eurobond and Eurodollar market could grow indefinitely.

It was very early days for the Eurobond market in 1963, but the scale of its potential had been revealed. This was a critical juncture in global financial history. If nothing was done to put an end to this fiasco, it could rapidly morph into an unstoppable beast.

A Silver Bullet

By 1963, dictators, cartels and corrupt officials were grasping the potential of these new Eurobonds. It was now possible to invest all those off-shore dollars into a product that would pay tax-free interest and be converted back into cash at the owner’s discretion.

As long as the Federal Reserve continued to issue currency that quietly found its way off-shore, the Eurobond market could expand ad infinitum. Globalist bankers were making colossal profits by creating, managing and brokering these bonds, and the enemies of America were riding on the back of the mighty US dollar.

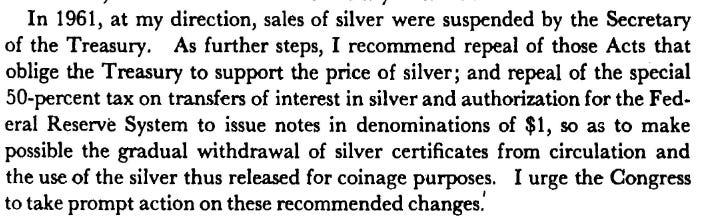

The only thing that could put a stop to this scheme would be a competitor that could put an end to the Federal Reserve’s monopoly on the issuance of US currency. Interestingly, when JFK became President of the United States, he supported the Federal Reserve. In 1961 he also wanted to phase out silver from America’s monetary system:

By 1963, the news about Siegmund Warburg’s Eurobond innovation permeated throughout the financial world. The implications for America were clear; foreign deposits offer better interest rates and were tax-free. If something was not done, US dollars would be drained from American banks, turned into Eurodollars, strengthening America’s competitors, and funding its enemies.

There is little doubt JFK would have been made aware of this situation. Considering that at the time the Korean War, the Cuban missile crisis and the growing concerns about Vietnam were front and center in the American psyche, the President had to do something to halt this Eurodollar tsunami.

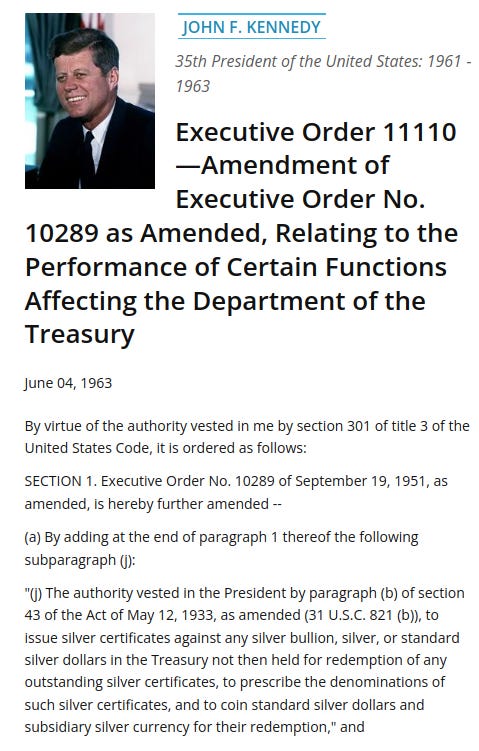

On June 4, 1963, JFK had changed course completely, reversing his previous policy with respect to monetary silver:

What would be a consequence of EO 11110?

“Kennedy knew that if the silver-backed United States Notes (USN) were widely circulated, they would eliminate the demand for Federal Reserve Notes (FRN). This is a simple matter of economics. USNs were backed by silver and FRNs were (still are) backed by nothing of intrinsic value.”

If Kennedy’s silver-backed USNs eliminated demand for Federal Reserve money, the Eurodollar could potentially become worthless, along with the entire banking complex now attached to it. It would mean those holding Eurodollars and Eurobonds would lose their entire investment.

Kennedy had just pissed off the City of London banksters AND every global despot, dictator, mobster and corrupt politician who were secretly holding tax-free Eurobonds off-shore. He had pissed them ALL off.

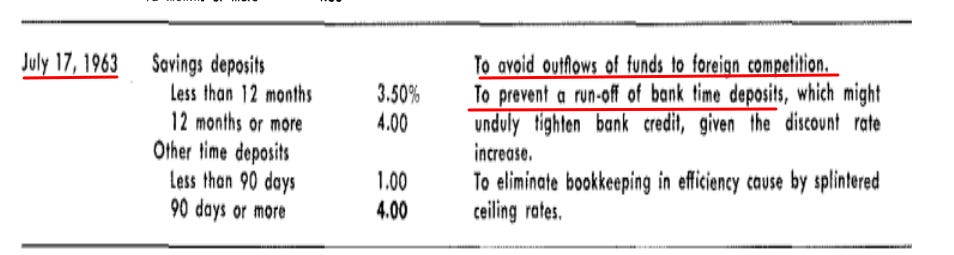

The Eurobond business was in the process of launching, and JFK was taking steps to put a halt to it. To understand how big a concern the Eurobond market was at the time, we can go back to the Federal Reserve minutes, and their adjustment of Regulation Q, just one month after JFK’s EO 11110. From the St Louis Fed, we note:

Everyone knew that US dollars were flying off-shore and into the Eurodollar market. Many were making anonymous fortunes in the process. EO 11110 was a ‘silver bullet’ that unfortunately did not find its intended mark.

On November 22, 1963, John F. Kennedy was assassinated.

The Return and Rise of Prussia

After Kennedy’s assassination, the Eurodollar and Eurobonds took on a whole new dimension. It was a financial product with unlimited potential:

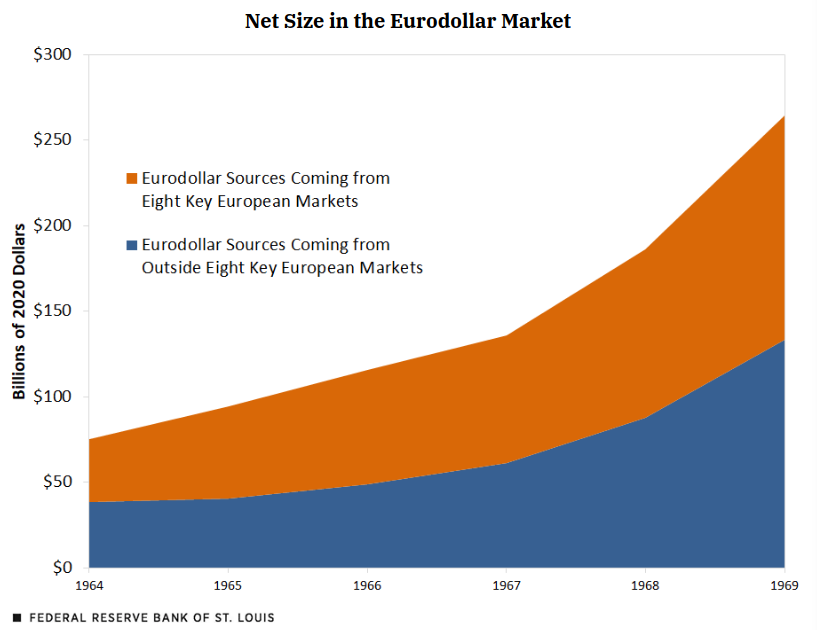

The ‘Euro’ dollar got its name because the initial place where vast pools of US dollars accumulated was in post-WWII Europe, mainly kicked-off by the Marshall Plan. However, the above graph shows the rise of Eurodollars ‘outside of European markets’, from 1964 onwards.

That was primarily due to the major geopolitical unrest in Asia. The Vietnam war was going hyper-kinetic, and newly printed Eurodollars were flooding into Asia:

The global Eurodollar phenomenon was in full-blown beast mode. More Eurodollars meant more Eurobonds. The issuance of more Eurobonds meant more profits for the holders. Between 2.5 – 4 million lives were lost in Vietnam and sadly, this illustrated the financial incentive that sits along-side, or maybe even behind, war.

Unbeknown to most people, another transition was occurring on the economic front that would shape the world for decades to come. As the Vietnam War was raging and Eurodollars were moving all around the world, an old power quietly re-emerged onto the global scene:

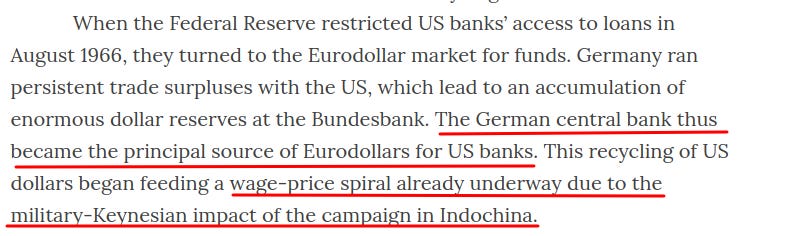

Yes, you are reading this correctly. The German central bank became the largest single source of Eurodollars for US banks. This was the same bank that had evolved from the original creation of Frederick the Great’s Prussian central bank.

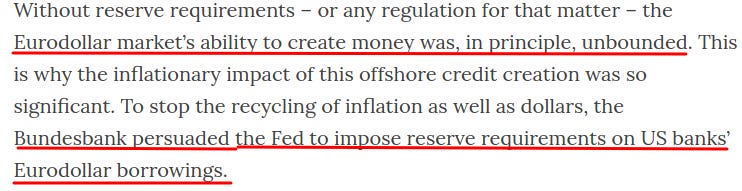

The story does not end here. Now that a re-invigorated Bundesbank (formerly the mighty Reichsbank) had all these Eurodollars, they began to tell America what to do:

Prussia was back with a vengeance. The dollars in their coffers were far more powerful than if they were in America because they were free from regulation. Prussia’s ability to control America appeared to be returning.

It can never be stated enough; the value of the mighty US dollar is derived from the blood, toil and labor of hard-working Americans. However, the power of the mighty US dollar was now in the hands of those exempt from US regulation. By 1971, the German Bundesbank was the largest holder of Eurodollars. Prussia had once again assembled ‘an army that controlled a nation’.

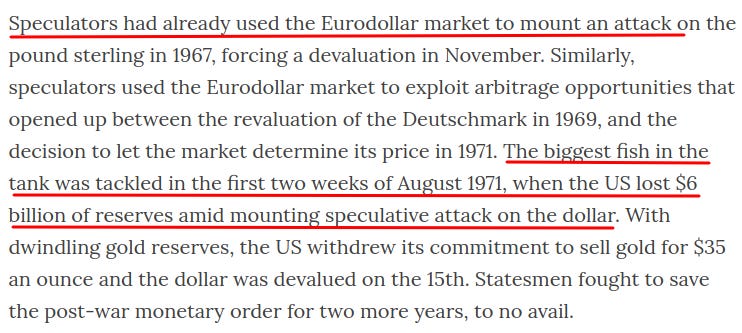

This new power was immediately deployed. With the Vietnam war raging, global currency wars exploded:

The emergence of this financial system was spectacular:

- Eurodollars were originally used to rebuild West Germany and parts of Western Europe, as Hermann Abs allocated Marshall Plan funds from the US.

- A large chunk of these Eurodollars ended up in Swiss banks, laying the foundation for Eurobonds, which were the brain-child of Siegmund Warburg, a close friend of Hermann Abs.

- This tax-free, regulation-free, and transparency-free system meant that American dollars fled to these off-shore havens.

- The bulk of these Eurodollars eventually found their way into the German Bundesbank, and within a few short years the mighty US dollar that had rescued Germany, was under attack by Germany.

- By 1971, the might of the original US dollar was broken, and had degraded into a common fiat currency.

In ReichsWEF – Part II we outlined the geopolitical events that surrounded the de-pegging of the US dollar from gold. The man conducting most of the operations for America at that point, was German-American Henry Kissinger. Kissinger was mentored by German-American, Dr. Fritz Kraemer, who we noted was well known within the US:

https://truthtrench.org/?p=3673

The strategy to destroy America now sits in full view for us all to see. Under the guise of economic prosperity, the Prussian regime had begun white-anting the entire American way of life. This financial control would eventually lead to an all-out assault on Constitutional freedoms, which is what we are seeing today.

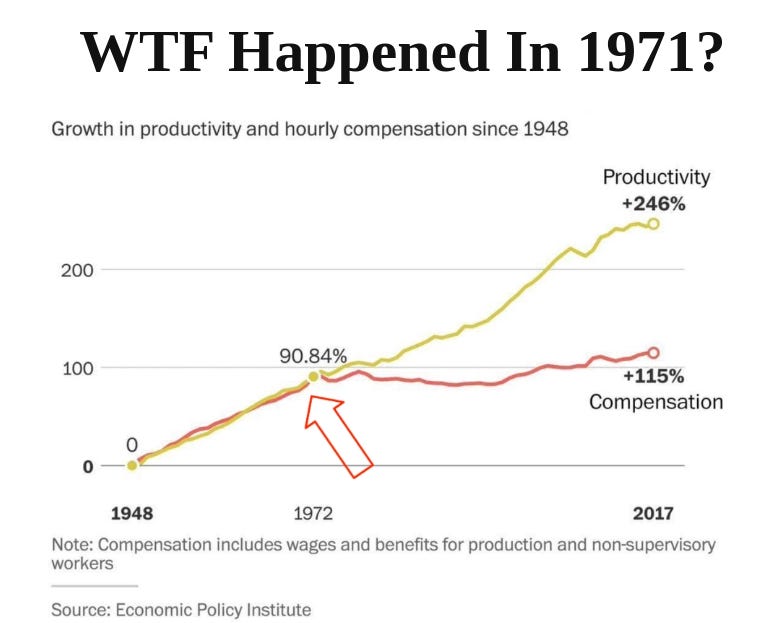

This invisible enemy is methodical and extremely patient. When the US dollar went off the gold standard, America’s middle-class began a long march into decline. To get a great overview of how the world changed since 1971, please take the time to check out the graphs and statistics at:

The Biggest Market Nobody Knows About

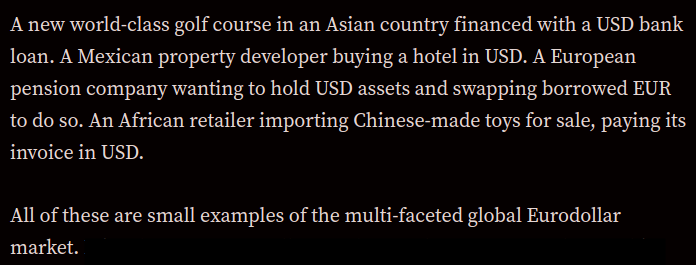

You may now be asking, what all this Eurodollar stuff has to do with me. In short, it has everything to do with us all:

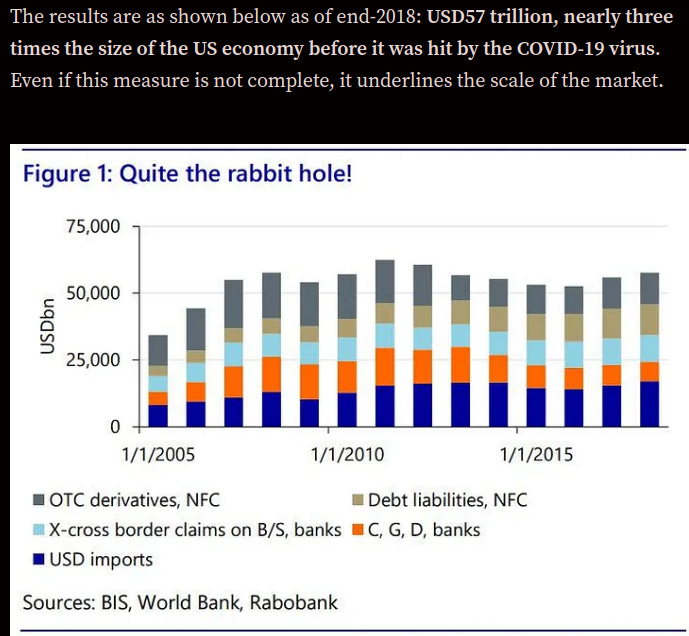

Every central bank around the world is dependent on Eurodollars as their major reserve currency. How large is the Eurodollar market today?

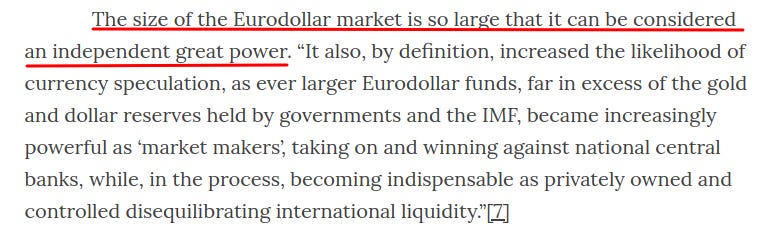

America has been the world economic superpower for decades. Somehow, the Eurodollar has surpassed the US economy three-times over, and very few people are even aware of it:

If the Eurodollar had truly become an “independent great power”, it achieved this with very few even knowing of its existence. Recall, the term “great power” was first termed following the Congress of Vienna in 1814. One of those Great Powers was, of course, Prussia.

This series, and the body of #PrussiaGate research, has shown that the Prussian ideology lives on within international corporations and a cabal of global bankers. Prussia truly does remain a Great Power or ‘sovereign state’ which is exerting incredible influence over the earth. It has found its way into every central bank, the largest companies on earth, and into most financial transactions, worldwide. It has achieved all this in the dark of night, invisible to everyone.

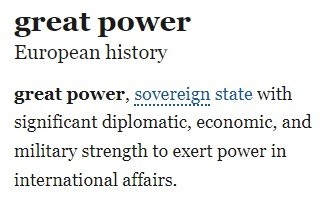

Today, the Eurodollar is, by far, the biggest game in town. Eurodollar futures are even traded on the Chicago Mercantile Exchange (CME):

Two Currencies, One Value

We must never forget the original premise of #PrussiaGate, which states that the greatest enemy of America and her rights and freedoms, is Prussia. Prussia is not a nation, but an army that controls nations. We can now observe that after WWII, Prussia did not disappear, it simply became invisible, hiding behind a myriad of globalist corporations and central banks. Its mission is no longer to control a single nation, but the entire world.

Analyzing the origin and evolution of the Eurodollar, and the financial innovations hanging from its every branch, we see that we are dealing with a behemoth that has infiltrated every aspect of our lives; exerting its Marxist ideology over every aspect of society. It truly is a great independent power.

At this point, it is worth asking a couple of questions: What can we do? Is there any hope of gaining freedom from this beast?

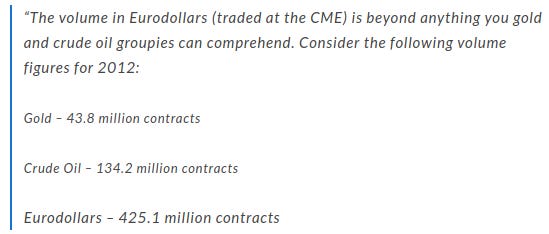

To answer both these questions, we must observe that the Eurodollar derives its power from the value of the US dollar. We must then ask, what backs the US dollar?

In other words, the US Treasury is stating that it is the capital and labor of hard-working American people that “backs” the USD. Therefore, the Eurodollar’s power is directly extracted from the American economy; by the goods and services provided by the People.

To be clear, this $60 trillion is located off-shore, free from American regulation and tax, and yet still enjoys the full purchasing power given to them by the hard work of the American people. The US Treasury clearly states what “asset” backs these dollars; it is We the People.

Eurodollar holders are the number one client of the US Federal Reserve, because they hold most of the Fed-issued currency. If Eurodollar investors are displeased with the Fed’s monetary policy, they can sell their dollars. If this happened en-masse, America would experience a hyperinflation that would make the 1920s Weimar hyperinflation look like a game of monopoly.

In a very real sense, the Federal Reserve is now beholden to the monster they helped create. Eurodollar holders do not want the American economy to die, as that would destroy the value of their investment. Instead, they simply wish to extract as much as possible from the American economy, via interest-rates. Relevantly, interest rates are determined by the Fed and the Eurodollar futures contracts. Once these rates of return are set, all that is required is that American people continue to ‘back’ this currency with their hard labor and entrepreneurial skills, thereby maximising “the goods and services in the economy”.

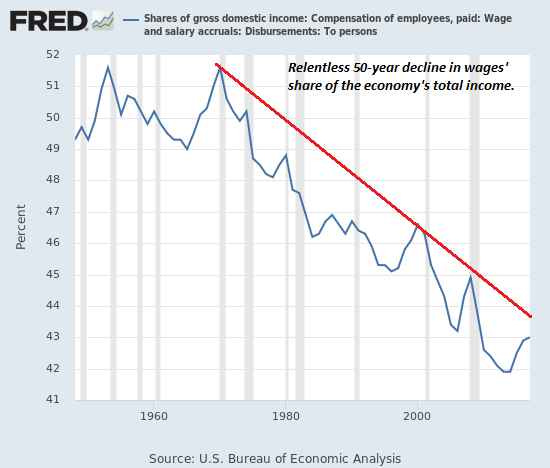

That is why American wages have significantly fallen behind American productivity since 1971:

What the graph above illustrates is that the American worker is no longer part of the great American dream. This is Hegel’s master-slave dialectic on full display. After 1971, the Eurodollar is now the master controlling the US economy, and enslaving the US people.

Let’s draw breath and summarize this entire situation through a Prussian lens:

- The Warburg banking family are from the Prussian town of Warburg.

- Paul Warburg emigrated to America and was the architect of the US Federal Reserve, which he modelled off the German Reichsbank.

- Max Warburg was instrumental in the German Reichsbank until the late 1930s, working with commercial bankers, and Hermann Abs, to “Aryanize” Jewish owned businesses.

- When America and Nazi Germany fell into war, the US Fed and Reichsbank were instrumental in the financing of their respective militaries.

- The trail of destruction in Europe after WWII, led to the deployment of billions of USD into Germany and Europe via the Marshall Plan.

- Hermann Abs oversaw the allocation of Marshall Plan funds. A few years later, his good friend Siegmund Warburg invented the Eurobond, allowing great amounts of wealth to be packaged up into Eurodollar bearer-bonds, receiving tax-free interest, and redeemable at almost any bank in the world.

- Frank Renouf, a New Zealand POW in Germany, is released after WWII and assists Hermann Abs in the financial re-construction of West Germany. New Zealand introduced innovative and favorable new Trust laws. Upon returning to New Zealand, Sir Frank Renouf establishes the country’s first merchant bank and is instrumental in creating trusts.

- In 1975, the Church Committee discovers that Hermann Abs was receiving dark-money from Lockheed into foreign accounts that have also been used to hide enormous wealth on behalf of criminals, despots and corrupt officials. In 2021, the release of the Pandora Papers showed that New Zealand Trusts were used in this global finance scheme.

- The invention of the Eurobond by Warburg gave birth to the monstrous Eurodollar market. President Kennedy reinstated the silver-backed certificates to stop the gargantuan flow of Eurodollars from occurring, but was assassinated before the program took hold.

- The Eurodollar is then used to successfully attack the USD gold-standard, which ultimately leads to the slow destruction of the American middle-class.

- The Eurodollar is now the world’s largest financial market, and is considered even to be a “great power”. Its fate is tied to the fate of the USD, meaning it is supported solely by the blood, labor and toil of all Americans.

Never forget that the Prussian way is to remain in a constant state of war. They yield to no one, and they use infiltration, instead of invasion. Global banking is a significant part of this infiltration. When we look at the key players in the rise of the Eurodollar, we find a myriad of Prussian coincidences:

Nuclear Currency Wars

Rarely in history does the world have the opportunity to go into battle against the horrible invisible enemy. 1963 was the last time this battle was waged, and it ended badly for We the People.

Exactly sixty years later, humanity is being given another chance. The Eurodollar is the biggest game in town, and the world is mobilizing against this gargantuan financial parasite.

In The House of Saud we presented the history of Islamic fascism and how it began with a partnership between Hitler and Hassan al-Banna, who founded the Muslim Brotherhood. Almost every radical Islam organisation and terrorist today was derived from the Nazi/ MB partnership. However, the CIA had taken control of the Muslim Brotherhood from the 1950s, and it served as a destablization mechanism in the Middle East. A region which is unstable, can be easily controlled.

https://truthtrench.org/?p=3637

When Eurodollars were used to break the USD gold-standard in 1971, the US Federal Reserve printing press was unleashed. However, there needed to be a new incentive for global investors to buy American dollars. Henry Kissinger was all over it:

“1973-1974… To maintain global dollar demand, Washington creates the petrodollar system. The first to enter this arrangement is Saudi Arabia. The Saudis agree to price all of their oil in U.S. dollars and even to invest some of their profits into U.S. Treasury securities. In exchange, the U.S. provides weapons to the Saudis, along with U.S. military bases to “protect” the Saudi oil fields.”

With the Saudi stage having been set, this moment marked the launch of the “Petrodollar”. As long as the world was forced to buy oil in USD, the demand for dollars would continue unabated. However, to enforce the Petrodollar complex, Americans had to spend trillions on military campaigns throughout the world. Essentially, the military industrial complex that Eisenhower warned of in 1961, had been deployed with a sinister new purpose. Nations were literally forced to participate, and there was little regard for the thousands of American soldiers who lost their lives to protect the Petrodollar.

There is one glaringly obvious aspect about the Petrodollar:

The Financial Times not only states the obvious, but says the quiet part out loud. The Eurodollar is dying. There are nations who no longer wish to be under its control:

If we consider the military campaigns America has undertaken in the past to enforce the Petro/ Eurodollar standard upon the world, the brazen declaration by BRICS nations seems like an open declaration of war.

That is exactly what it is.

The world is in the midst of the greatest currency war in history. However, this is not a war against the American people; it is against the Eurodollar. Unfortunately, the hard-work and productivity of Americans has been unknowingly chained to the Eurodollar behemoth, resembling somewhat of an economic hostage crisis.

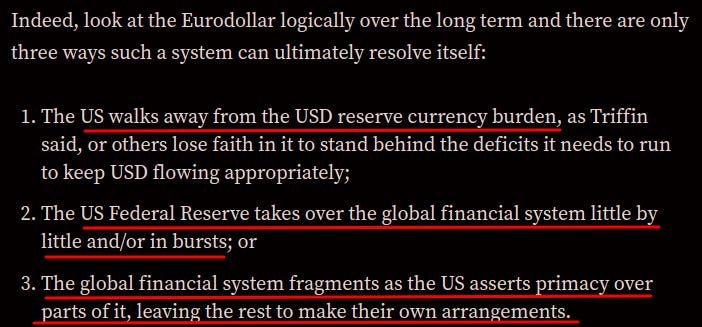

#PrussiaGate uses history to understand the present. We are not prophets, and we cannot predict the future. The future is always uncertain, especially during a war. However, with respect to the Eurodollar, the smartest financial men in the world have narrowed down the fate of the currency into three options:

Let’s work backwards through these options:

Option 3:

With the emergence of BRICS, the global financial system is already fracturing. Nations would then be free to form trading-blocs or negotiate trade agreements on a nation-by-nation basis. The Eurodollar would no longer be required for global-trade. Notably, President Trump was also busy building alliances to counter BRICS, thereby confirming parts of Option 3 playing out in the real-world:

Option 2:

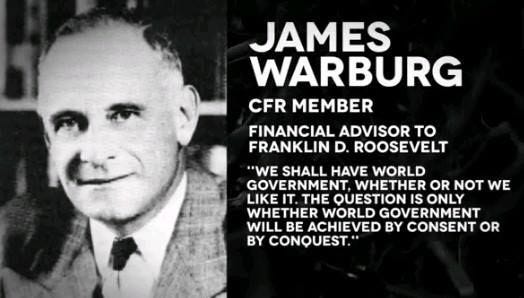

The Federal Reserve would effectively take over the entire world. While this sounds highly improbable, it is important to understand that the Eurodollar is a function of the Federal Reserve. The architect of the Eurobond was Siegmund Warburg. The architect of the Federal Reserve was Paul Warburg. The son of Paul Warburg, was FDR advisor, James Warburg, and James was not subtle in his vision:

When we look at the Prussian origins of the Federal Reserve, the evolution and power of the Eurodollar, and the members of the ReichsWEF openly calling for a “World Government”, a plan that has been invisible for over a century, is now revealed for all to see.

Option 2 is the clear objective of the Horrible Invisible Enemy. Prussia seized the world, and it intends to control the world. Their mantra is as relevant today as it was centuries ago: “Kill or be killed.”

Option 1:

Option 1 looks at how America could simply “walk away from the USD reserve currency burden”.

Recall in 1963, when JFK issued EO 11110, the Treasury began issuing silver-backed certificates that would compete with the Federal Reserve Notes (FRNs). Siegmund Warburg had just figured out a way to turn Eurodollars into a never ending profit engine. His FRNs could not, under any circumstance, have a competing US currency. Within months, JFK was assassinated.

While JFK’s assignation was horrific, it provided the world with a glimpse of the Achilles heel of the Eurodollar; hard-currency. Money backed by gold or silver would never have resulted in the endless printing of Eurodollars.

Today, if a similar certificate was re-introduced into the US, it would “put an end to the endless”, and potentially destroy the Fed.

A Final Thought

Regulation Q intended to stop banks from engaging in reckless and speculative ventures using the American people’s hard-earned savings. Since the birth of the Fed, banks have repeatedly made colossal blunders that destroy the global economy and plunge billions into poverty. Regulation Q was a leash that forced bankers to bank, and not speculate.

If Treasury issued hard-currency then it would begin to destroy the value of the Eurodollar. The consequences of this would be unfathomable. However, we are merely dealing with financial chicanery; it is an illusory pricing mechanism that has taken control of the real world. Take heart in the fact that if the Eurodollar disappears, the real world still exists.

The factories, machines, farms, innovators, workers and unlimited potential of the human spirit will still be here.

All that disappears is the Eurodollar and the bonds that it spawned. The bribe money received by corrupt bureaucrats, that are untouchable by American authorities because they are “concealed and in foreign accounts” will disappear. The hidden wealth of dictators with their communist and fascist regimes that enslave and impoverish their own citizens will disappear. The myriad of tax havens which provide anonymous investment vehicles for the corrupt will shrivel up to nothing. Should the Eurodollar disappear, so too would the vast fortunes hidden from We the People.

While the scale of all this seems so large, the choice of which way we go, is driven by We the People.

During President Trump’s first term in office, he embarked on a bold strategy to “Make America Great Again”. It was about restoring jobs in manufacturing; placing equalization tariffs on China so that industry was incentivized to return to America. He was about securing the border, becoming energy independent and freeing up regulations to maximize the productivity of the REAL world in America.

When the music stops, the Eurodollar will vanish and America will have to stand on its own feet again, along with every other nation in the world. Those with resources, factories, farms, labor and innovation will thrive. So too will nations willing to trade on fair and equal playing fields.

When we consider the implications of the Eurodollar collapsing into the abyss of financial history, it sheds new light on the intent behind the objectives and accomplishments of President Trump’s first term in office. His administration was preparing America for a real world, free from the chains of the Eurodollar. When you see the people and organizations that have mobilized against Trump, and those who support him, you can now see clearly the enemy and their intent in this horrible, invisible war.

MAGA.

The End.

https://mises.org/library/how-fed-helped-pay-world-war-i

https://sidrahnicole.weebly.com/stock-market-crash.html

https://allaboutthetwenties.weebly.com/the-1920s-stock-market.html

https://www.federalreservehistory.org/essays/glass-steagall-act

https://www.federalreservehistory.org/essays/glass-steagall-act

https://www.wallstreetmojo.com/eurodollar/

http://caen-sccm-cdp01.engin.umich.edu/the-eurodollar-market.php

https://www.sfu.ca/~poitras/EEH_Eurodollar_98.pdf

https://www.sfu.ca/~poitras/EEH_Eurodollar_98.pdf

https://www.sfu.ca/~poitras/EEH_Eurodollar_98.pdf

http://www.schloss-uhenfels.de/

https://www.theguardian.com/books/2010/jul/11/high-financier-siegmund-warburg-review

ibid

ibid

ibid

https://archive.org/details/EconomicReportOfThePresidentJanuary1963/page/n21/mode/2up?view=theater

https://news.google.com/newspapers?id=-q8fAAAAIBAJ&sjid=LdcEAAAAIBAJ&pg=2964,4612588&hl=en

https://foundationfortruthinlaw.org/jfk-vs-fed.html

https://files.stlouisfed.org/files/htdocs/publications/review/70/02/Administration_Feb1970.pdf

https://www.stlouisfed.org/on-the-economy/2022/january/bretton-woods-growth-eurodollar-market

https://timesmachine.nytimes.com/timesmachine/1975/05/01/issue.html

ibid

ibid

ibid

see footnote 35

https://www.britannica.com/topic/great-power

https://www.rcmalternatives.com/2013/08/eurodollars-the-biggest-market-youve-never-heard-of/

https://seekingalpha.com/article/145722-what-really-backs-the-u-s-dollar

https://www.ft.com/content/daa52688-db6a-385e-a313-ef9f3cb6e36e

https://www.orfonline.org/expert-speak/brics-reserve-currency/