Summary

Slavery is one of the oldest businesses on earth. This series will explore the evolution of slavery and the ways in which the Prussian rulers, or invisible enemy, continued to maintain their control over humanity, in such a way that is not obvious.

#PrussiaGate has provided significant evidence that the invisible enemy currently utilizes the realm of international law, controlling nations via various treaties and agreements. International law is the realm of corporate law, civil law and statutes, meaning that mandates are offered, inviting nations into agreement. Generally speaking, it is only with the agreement of two parties, that mandates become legal.

Most major treaties on earth were signed during a war, or soon after. In this context, they appear to be peace treaties, however if you look carefully, you’ll see they are cleverly crafted trade agreements. Essentially, the war was postponed, provided that all parties agreed to act in accordance with the treaty. While these treaties could be wide-ranging in scope, the major provisions during the Great Wars related to the use of certain seas and ports. Treaties are often revised, but usually within the context of the one that preceded it. The means that a partial war-time context still exists within the world.

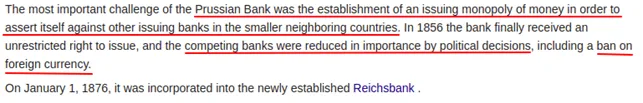

#PrussiaGate has shown how the establishment of the US Federal Reserve played a significant role during WWI. General Smedley Butler pointed out the enormous profits made by American corporations during the war. American and German corporations then built a staggering amount of wealth in the following decades. We have highlighted the role central banks play in controlling nations, via national debt. This context has resulted in a form of debt slavery, where behavior can be controlled, ensuring humanity is in a form of captivity.

Understanding debt slavery requires an understanding of central banking. Understanding central banking requires an understanding of trade. Understanding trade requires an understanding of merchants. Part 1 of this series will take you on a deep dive into the origins of trade, as we further understand the hold that Prussian ideology has on the earth.

Trade Cometh Before Banking:

A Clash Between Two Economies

Throughout the ReichsWEF series we mentioned Henry Kissinger’s obsession with Thucydides trap as it applied to China-US relations. According to one of Kissinger’s oldest students, Graham Allison, today the world is on the brink of a catastrophic war between the rising power of China and the falling power of America. In this “Thucydides Redux”, Allison makes no apologies as to what he believes is the solution:

Thucydides was an Athenian general who wrote the contemporary History of the Peloponnesian War between Athens and Sparta. “It was the rise of Athens and the fear that this instilled in Sparta that made war inevitable.”

Why was the rise of Athens such a concern to Sparta? The answer may lie in the economic model Athens chose, and the Spartan realization that their days of supremacy were numbered.

The Spartan Economy

“In Sparta their economy relied on farming and on conquering other people. They did not have enough land to feed all their people so they took their neighbors land. In Sparta they used slaves and noncitizens to produce the needed goods…………Sparta discouraged trading overall. They believed that contact with other city-states would give them new ideas, and then weaken the Spartan government. It was difficult to trade with Sparta because of their money system. They did not have coins so they used heavy iron bars. A legend says that they used iron bars because it was harder to steal them because they were so heavy. Other city-states were not anxious to receive the iron bars.”

In short, Sparta relied on their military to implement a direct master-slave society. If you were Spartan, you would train for war. If not, you were enslaved for Sparta.

Trade was discouraged, along with new ideas. Sparta was the ultimate totalitarian society. Nothing new was allowed because Sparta already had the “total” concept. Adopting iron bars as currency was generally viewed by other city states as a Spartan shit-coin; no one wanted them.

Sparta was effectively a closed, centralized, command economy. Rather than develop a trade network to import the goods they needed, their preference was to conquer and enslave the regions which could supply them.

The Athenian Economy

“In Athens their economy was based on trade. The land that surrounded Athens didn’t provide the people with enough food. Athens was near the sea which was good because it meant they had a good harbor, and that they could trade easily……………….Athens developed their own money system. They made coins made of gold, silver, and bronze.”

This approach was in stark contrast to Sparta. The exponential rise in prosperity that Athenians experienced during this period was based on trade and a multi-metallic monetary system. Their economy began to evolve in complexity and allowed for the birth of free-thinkers such Socrates and Plato; both have heavily influenced Western civilization ever since.

Sparta believed that new ideas would weaken their city-state. Athens believed that trade could deliver new ideas. This brought prosperity and became the driving force behind their power. This was an impossible paradox for Sparta to solve. As Athens relentlessly grew in economic and military might, Sparta’s only viable option was to go to war.

It was a clash between two competing economies. The Pelponnesian War lasted for decades. While Sparta was the ultimate victor, the economic model of Athens had shown future empires how free-trade and free-thought can deliver immeasurable prosperity to its citizens, and unimaginable power to its rulers.

Trade is Power

Many empires have risen and fallen since Ancient Greece. A commonly accepted principle evolved amongst emerging empires:

- trade creates wealth,

- wealth creates power,

- therefore, those who control trade, have the power.

Trade routes provide the key ingredients for a thriving economy, and therefore a strong empire. Access to cheap labor (ie: slaves), natural resources, finished goods and innovation all comprise an empire’s capital. Trade was the engine that empowered empires.

A quick background into global trade will provide a valuable foundation for this series.

Carthage

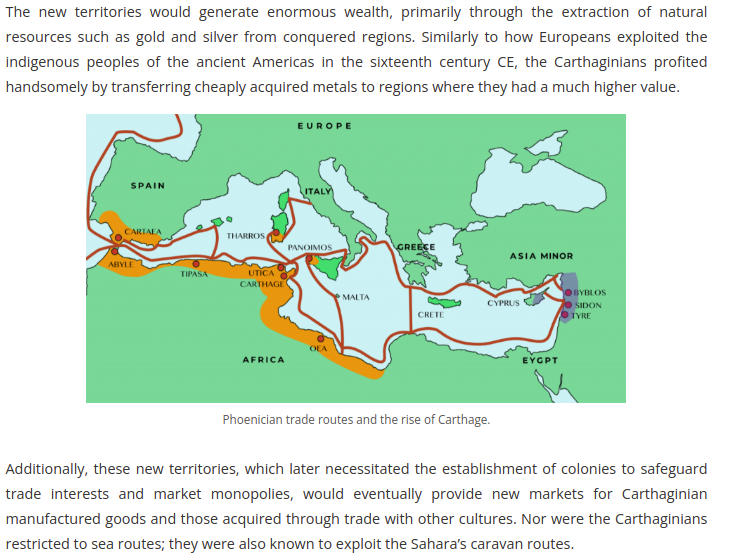

Carthage was by far the richest city in the Mediterranean. Their immense wealth created a ruling class that would spare no expense in glorifying their Phoenician origins, and the religious practices that accompanied it.

As Carthage grew fat on the wealth secured by their trade routes, another empire was slowly building on the other side of the Mediterranean.

Ancient Rome

The Roman empire originally developed as a land-power. The empire’s initial growth was not directly affected by the mercantilist practices of Carthage, which predominantly worked the Mediterranean trade routes. However, as Rome grew, it became evident that her economy was prospering in the same way as the Carthage empire was. Both empires had secured lucrative trade routes.

The power and might of the Roman military was used to expand and secure the empire. However, the decisions of where to expand were likely informed by the trade routes that were developing, and the various products that merchants were delivering to Rome.

With both empires expanding trade routes, Rome’s military conquests eventually led to an unavoidable conflict with Carthage. 264 BC began the first of the great Punic Wars. Three major confrontations between Carthage and Rome led to the eventual annihilation of Carthage in 146 BC. Rome eventually rebuilt Carthage as a Roman city, and continued its expansion for centuries.

The control of trade was essential to deliver an empire the wealth needed to maintain security and continue its expansion. However, trade routes would also become the prize of rival empires, which would ultimately lead to conflict and end in potential annihilation. Expansion of trade therefore, carried significant risk.

Khazaria

One of the most powerful and least known empires of the West was Khazaria.

The Khazarian empire played a critical role in the early development of Western Europe. Their empire was strong, militant and on a constant war-footing. Due to its geographic location, they sat at the frontier between Western Europe and the Arabian tribes attempting to invade Europe:

The Khazars were so valued by a decaying Roman Empire, that Khazarian powers eventually managed to infiltrate Europe:

“a tangible form through another dynastic alliance, when their heir to the throne was married to a Khazar princess, whose son was to rule Byzantium as Leo the Khazar.”

One of the most important factors in the rise of the Khazarian empire was its location.

The Khazars had taken control of some of the most valuable trade routes in the world. Not only trade between East and West, but also the trade between the Byzantines and the fierce ‘Rus’ (or Russians), to the North:

Khazaria’s prosperity and power was not due to trade directly, but the control of trade routes and the rights to levy taxes (estimated to be approximately 10%) on all goods the merchants brought through their lands. The success of their tax collection was directly correlated to the strength and ferocity of their permanent standing army, which would be ordered to destroy anyone who refused to pay-their-way.

For centuries this strategy proved to be very successful. The power and influence of the Kagan (or king of Khazaria), was renown. However, the control of trade would eventually irritate the mighty Rus, and a confrontation with the Khazarian Empire was only a matter of time.

While the Rus initially paid the Khazarians to cross the Black Sea and plunder the lands to the South, this fiscal arrangement would not be permanent. History is opaque as to the exact nature of the fall of Khazaria, but it did involve fierce battles from the growing power of the Rus. The Khazars knew all too well the menace facing them from the North, and began making plans to defend against them, on the Azov Sea:

Eventually the might of Rus became too strong for the Khazarians, and their empire was obliterated into the annals of history.

Trade routes and the reach of an empire

The Halls of History are awash with examples of empires whose rise can be attributed to the access, creation and control of trade. Those same empires also suffer a cataclysmic decline as rival powers seek to fight and takeover trade routes. The rise and fall of empires, therefore, is inextricably linked to their ability to trade.

However, Athens, Carthage, Rome and Khazaria all pale in comparison to one of the greatest trading empires in world history.

The Hanseatic League

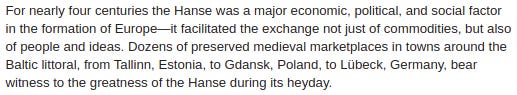

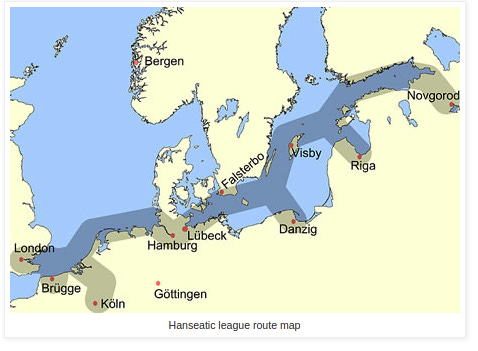

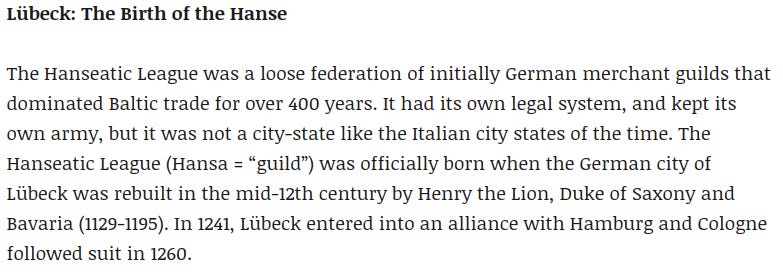

Before the empires of Portugal, Spain, the Netherlands or the British were established, and well before the birth of Prussia, the Hanseatic League staked its claim as one of the biggest players in European history:

It is important to note that members of the Hanseatic League were granted their autonomy by the Holy Roman Emperor, and were referred to as “Free Imperial Cities”. As the Hanse merchant’s trading enterprises grew exponentially, so did their power and influence, as well as a few other fringe-benefits:

Perhaps the most significant achievement of the Hanseatic League was the establishment of the Steelyard (Stahlhof) in London, along with several privileges handed to them by the Crown.

Granting concessions to the Hanse merchants was a poor decision. The same concessions were not reciprocated to English merchants in Hanse cities, and so the English merchants suffered from an uneven playing field. This, along with the exclusivity and secrecy of the Steelyard, led to growing tensions between England and the Hanseatic League. Eventually, these tensions spread further abroad:

The Hanse had grown so powerful that they could no longer be considered as just a conglomerate of merchants. The Hanse had monopolized trade on the Baltic and North Seas. The wealth generated by controlling Baltic trade afforded them many luxuries; one of them being a powerful military. Moreover, if a kingdom disagreed with the terms and conditions of the Hanseatic League, they could effectively cut off the supply chain and plunge that nation’s economy into a depression prior to the use of military force. Any war against the League would not just be military, but also economic:

Eventually, the Hanseatic League managed to piss off too many kingdoms, all at once. The ensuing wars were proving costly and provided little return on investment. Trading privileges were rescinded; local merchants attacked, ransacked and destroyed Hanse trading houses; in some cases, Hanse merchants were assaulted, and even executed.

Conventional history tells us that the Hanseatic League began a multi-century descent into oblivion:

However, #PrussiaGate contends that all things that involve this Horrible Invisible Enemy do not simply vanish into the history books. This enemy regroups, morphs, and moves forward in invisibility. The Hanseatic League, including the Prussian cities that were part of it, were no exception.

There are several aspects to the history of the Hanseatic League that require careful attention as we seek to bring into view that which has been hidden for so long.

The Birth of Modern Banking

We will address banking in more detail later, however it is worth noting that one of the ‘stated reasons’ for the decline of the Hanse was credit and innovation in banking:

This story is highly unlikely. The Hanse merchants were skilled traders. One of the key and timeless characteristics of a successful trader is the pragmatic approach to new ideas and systems. If the application of bills of exchange could provide an advantage to the Hanse, they would not only have adopted the strategy, but maximized its potential.

As we shall present later, the birth of modern banking did not destroy the Hanse merchants, but instead presented them with an opportunity that was too good to refuse. They would join the banking revolution of Europe.

The Thirty Years War

The Thirty Years War brought famine, plague, war and untold death to Europe from 1618-1648. However, at the end of the war, Prussia had risen from the ashes to become a kingdom and eventually would become a world superpower. Prussian cities that were part of Hanseatic League began to flourish. Over the next few centuries, Prussia came to dominate many of the cities that were part of the Hanseatic League.

The Great Fire of 1666

Recall in our article, 1666:

https://truthtrench.org/?p=3621&preview=true

In an amazing coincidence, the Great Fire of London destroyed one of the most important assets of the Hanseatic League; the London Steelyard.

The timing of this event and the resulting Prussian dominance of the cities that were part of the Hanseatic League begs further investigation. Was the Steelyard really destroyed or was it relocated? Did the Hanseatic League really disappear?

1862 Lubeck

Lubeck was the capital of the Hanseatic League. In 1862, the Hanseatic League was considered to be officially abolished. While it is contended the League never officially dissolved, perhaps what is more important are the events around 1862, particularly with respect to Prussia.

Recall in ReichsWEF I, the RealPolitik practiced by Otto von Bismarck involved three wars termed “The German Unification Wars”. These wars began in earnest after Bismarck’s infamous “Blood and Iron” speech:

https://truthtrench.org/?p=3671&preview=true.

Lubeck was a city of Schleswig-Holstein, and by 1866, had become part of Prussia. Prussia was slowly acquiring the old Hanse towns.

As we dive deeper into the demise of the Hanseatic League, a familiar pattern emerges. The devastation of the Thirty Years War and the Great Fire of London are events attributed to the demise and eventual disappearance of the most powerful trading bloc of the time. However, instead of collapse, the Hanseatic League appears to have not disappeared at all, but instead transformed itself into a far more sophisticated beast. As expected, Prussia have their finger prints all over it.

Medici and the Birth of Debt-Based Trade

Before we explore the idea that the Hanseatic League transitioned into invisibility, it is important to understand the origins of modern banking and how it has infiltrated every aspect of society today.

In its original iteration, banking was simply the safe deposit of a person’s cash, which were denominations of minted gold and silver coins. The role of banker was primarily as a high-security gold smith. A successful banker would not only be able to hold gold on your behalf, but would have branch offices where you could access your deposits almost anywhere in Europe.

While holding deposits, some of the early bankers began extending loans. Loans were a tricky and dangerous business. Should a borrower default on a loan, the banker may be unable to repay a depositor, and in many cases would end up hung, drawn and quartered. To avert this risk, bankers would only offer loans that were exceptionally over-collateralized. If borrowers were unable to repay their debts, they could end up losing their entire family fortune at the hands of the money-lenders. Banking was a ruthless and cut-throat industry where immense wealth was formed by only the shrewdest banking families.

Almost every banking dynasty we know today was formed by families who first began building their wealth as traders and merchants. The Florentine Medici dynasty were no different. Their contribution to the evolution of banking changed the economy of Western civilization forever.

(Lorenzo the Magnificent)

The Medici family began in earnest in the ‘rag trade’:

The banking innovation attributed to the Medici was the practice of “double-entry bookkeeping”.

The Medici were also innovators in financial structures and the issuance of letters of credit, or debt. All of this contributed greatly to the worldwide expansion of European trade. The secret to banker wealth lay within the double-entry bookkeeping formula:

This is a relatively well-known formula amongst financial operators today, but it was an exceptionally powerful tool in 15th Century Europe, especially for the merchant families who understood its potential at the time.

Example:

If a trader could return from the Silk Road with $1000 purchase of silk, its market value in Europe may fetch $10,000. This was a worthy trade. However, there were very few who could afford to pay the high prices demanded by silk traders. Therefore, instead of paying the trader up front, buyers would promise to pay the $10,000 over time. That promise became a loan agreement, and an asset for the trader.

For the buyer of the silk, they owned $10,000 worth of silk but also had a liability of $10,000 to pay back. To avoid default and potential bankruptcy, they would endeavor to pay back that loan as fast as possible. This could be accomplished by making a quick on-sell (flipping) or manufacturing the silk into a higher-end product for a value-added profit. The time pressure to pay back debt would force the European economy into overdrive, and productivity soared.

1492 was not just about Columbus “sailing the ocean blue”, it was about the same time as a new financial innovation occurred which laid the foundations for Europe to expand significantly beyond its borders. Traders would amass unimaginable wealth if they supplied Europeans with the high-end goods they were demanding. Silk, spices, gold, silver, slaves and many other goods were retrieved from every corner of the globe, as Europe paid more than any other civilization on earth. This was not taking place because they were necessarily richer, but because they promised to pay the highest price at a later date. Essentially, they had a medieval credit card. The efficiency and popularity of this debt instrument altered the course of humanity forever.

These debt instruments were efficiently administered first through the Medici ledger, and soon thereafter by the most successful trading houses in Europe. Traders no longer demanded gold and silver up front to pay for their goods; a letter of credit would suffice. This credit note would become their asset, with the buyer shouldering the burden of debt on the other side of the equation. When the amount of debt owed to a trading house became extraordinarily large, they were no longer traders; they had become bankers.

This marked the beginning of a debt-based economy, where one man’s wealth was another man’s debt. It launched many of the most infamous banking dynasties we know today into a world of incomprehensible wealth and power.

The Medici family rose to incredible power. Not only did they establish themselves as a powerful political force in Florence and beyond, they also became bankers to the Vatican. The family would produce four popes. At their peak, their wealth was so large they are known as the largest patron of the arts during the Renaissance era. They commissioned some of the finest buildings in Florence, and also supported artists such as Leonardo da Vinci, Donatello, Rafaello, and also patroned Galileo Galilei (who also tutored the Medici children).

From their origins as merchants and traders, the Medici morphed into a massive banking house and played a significant role in the development of Western civilization. They were not alone; many other trading houses had discovered the ‘Banker’s Trick’ and the wealth and power of Europe began rapidly centralizing into their hands.

Banking Dynasties of Europe

The Medici were just one of a plethora of families who transformed their trading activities into banking dynasties.

Rahn+Bodmer

Recall in ReichsWEF Part V, Klaus Schwab’s family had close ties with Swabian nobility. Klaus’ father, Eugen, worked for Escher Wyss, an old Swiss engineering company that provided aid to the Nazi war machine, including the ability for the Nazis to produce the heavy water needed for an atomic bomb. Klaus developed a close bond to the Bodmer family, and followed his mentor and middle-namesake, Martin Bodmer, to Switzerland where he established the World Economic Forum.

https://truthtrench.org/?p=3681&preview=true.

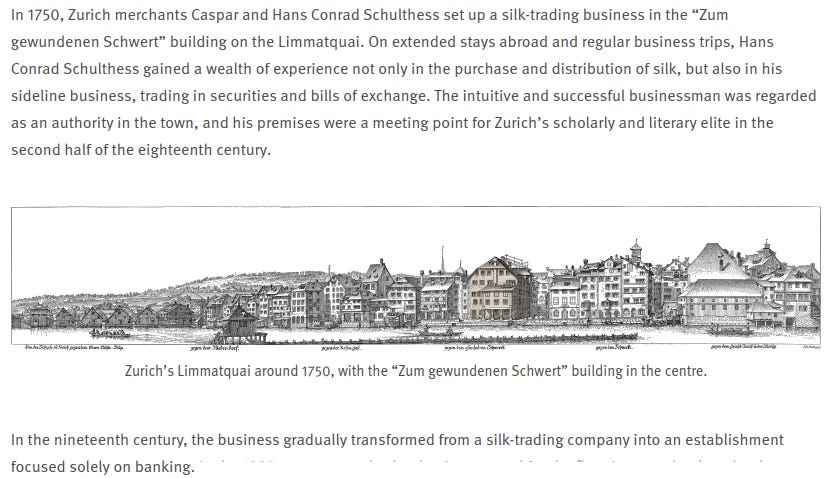

Zurich’s oldest private bank, Rahn+Bodmer, was formed by some of the wealthiest Swabian families. The Escher, Bodmer and Schulthess families all helped in the evolution of the bank. Notably, their fortunes did not begin with banking, but with trade:

Berenberg

Established in 1590, the Berenberg Bank is known as the world’s oldest merchant bank:

The fact that Berenberg was a Hanseatic family is an important note for later, but the main point here is that the Berenberg established their banking empire from a successful cloth trading business:

The Berenbergs, and later the Gossler family, worked closely with one of England’s most powerful banking dynasties; the Barings family. Their wealth and power in Hamburg were duly recognized by Prussia, who later ennobled them as Barons of Berenberg-Gossler.

Warburg

We have presented in The Prussian Origins of the U.S. Federal Reichsbank and the series, Not Since 1917 the enormous influence the Warburg brothers had in global central-banking circles. Paul Warburg, known as the “Chief Architect of the Federal Reserve”, migrated from Germany and worked tirelessly to promote and establish the Federal Reserve central banking system in the US. He was appointed Vice Chairman of the Federal Reserve Board of Governors from 1914-1918.

His brother, Max Warburg, followed a similar path with the German Reichsbank. Despite the rise of the Nazi party, he served on the Board of the German Reichsbank from 1933, before emigrating to America in 1938. Both brothers served as directors in the notorious I.G. Farben conglomerate, whose war crimes were also outlined in the Not Since 1917 series.

The Warburg family almost certainly derived their surname from the town they emigrated to -Warburg. The town of Warburg was annexed by Prussia in 1802, however their original name was Del Banco, or “the Bank”, which was derived from their Venetian past:

The Altona and Danish branch of the Del Banco family kept the surname, while some adopted the surname of the town they had moved to; Warburg. What is more interesting, is their 11th century Venetian origins, whereby Venice had developed into a powerful mega trading-center:

The origins of the Warburgs was in a city state that had perfected the art of trade over many centuries.

The Rothschilds

Perhaps the most famous of all banking dynasties is the Rothschilds. The founding father of the Rothschild dynasty, Mayer Amschel, infamously stated:

This was a powerful statement, but Mayer Amschel was in no position to control any nation’s money at the time. He was simply admiring the most powerful man of his day, Frederick the Great, and his establishment of the Royal Main Bank. The control Mayer Amschel was referring to was Frederick’s:

However, the dynasty of the Rothschilds did not begin with banking; it began with trade:

Slowly, the Rothschilds built their empire from trade, which later included foreign exchange. As their trading empire grew, the move into banking was a ‘fait accompli’.

The infamy of the Rothschild dynasty knows no bounds. Their escapades during the Battle of Waterloo, dealings with the Bank of England, and many other historical events have made them a primary focus of modern banking history. Even today, Lynn Forester de Rothschild is working with Pope Francis to implement their vision of “Inclusive Capitalism”.

As we are discovering, “Inclusive Capitalism” is anything but inclusive. Unless you comply with their vision and mandates, you will be excluded.

(Note: If you wish to discover more about the pope, the Dutch Royal family and the Nazis, please read our article, The Prussian Pontiff)

https://truthtrench.org/?p=3639&preview=true.

When the sons of Mayer Amschel dispersed throughout Europe, it was Nathan Mayer Rothschild who moved to London, adding enormously to the family’s wealth and power. Starting out as a textile merchant in Manchester, it did not take long before Nathan was trading in bullion, foreign exchange and securities.

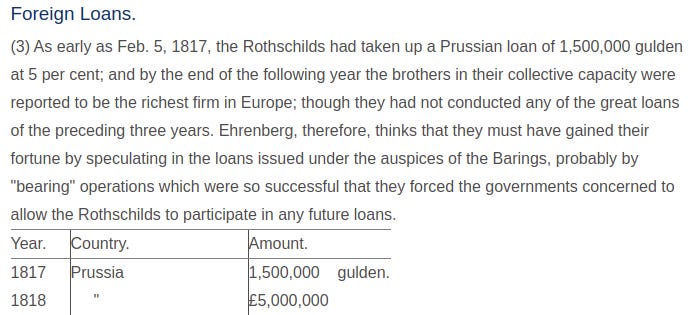

In the early years, they were in fierce competition with the likes of Barings Bank. However, in 1817, their meteoric rise really began when they started making huge foreign loans to nation states and kingdoms around the globe. Perhaps unsurprisingly, their first major client was Prussia:

Bankers Everywhere

With the birth of ‘letters of credit’ and its efficient administration using double-entry bookkeeping, Europe embarked on the greatest economic expansion ever in human history. The incentive to discover and secure trading routes led to the founding of many colonies throughout the world. The goods that were brought into Europe delivered enormous profits to the traders and merchants participating in these ventures

However, it was the letter of credit that allowed traders to receive payment for their goods at a later date, rather than demand an upfront payment in gold or silver, that ensured demand for imports remained high. This was akin to creating money out of thin air, and guaranteed that prices of imported goods would remain high despite them flooding into Europe. A wealthy merchant or trader, therefore, could amass huge fortunes by granting credit to customers willing to buy their goods but who did not have the immediate means to pay. It was truly the case of “one man’s wealth becoming another man’s debt”.

As Europe began its worldwide expansion, it was also being flooded with debt. The successful merchant or trading house would be flat-out administrating all the letters of credit in their portfolio, which would mark their logical progression into banking. Those with the ability to create money out of nothing would see the wealth of Europe gradually centralize into their hands, while the burden of debt would spread throughout society. Trade merchants had become merchant-bankers.

Despite the rise of the banking dynasties of Medici, Berenberg, Warburg, Rothschild and the Swabian houses of Escher, Rahn, Schutlhess and Bodmer, we are to believe that during the 12th-17th centuries the Hanseatic League, the most powerful trading block in human history, simply just faded away. Did the Hanseatic League truly disappear, or did it join the great Prussian transition into invisibility?

Hanseatic Banking Transformation

While almost every major trading house in Europe from the 15th century onwards progressed into banking, accumulating colossal wealth and power, it is hard to fathom that the largest and most powerful trading block in history simply dwindled into obscurity. There are several questions that deserve to be explored through the #PrussiaGate lens:

- Were the members of the Hanseatic League stupid and unable to see the enormous financial opportunity that letters of credit and double-entry bookkeeping offered?

- Did the Thirty Years War really destroy every facet of their trading empire?

- Did the 1666 Fire of London, which burnt their headquarters to the ground, truly mark the end of 500 years of trading dominance?

The first point to make is that members of the Hanseatic League were far from stupid. They were traders who took a pragmatic approach to everything. If another system proved better than their own, they would have immediately adopted it. Indeed, they were already exploring “sophisticated payment mechanisms”:

The Hanseatic League is likened to a medieval EU? It was the rise of nationalism that brought it down? This is certainly an interesting idea in the context of today’s monstrous European Union. One of the darlings of the EU, Angela Merkel, had no time for nationalism during her political tenure, especially with respect to the nation she led for 16 years.

Was Angela showing her allegiance to a force other than Germany? Perhaps an allegiance as some kind of neo-Hanseatic Helga?

The Hanseatic League was known for its innovation and sophistication. The claim by conventional history that the League did not keep up with the times is, to be blunt, complete bullshit. More likely, they were ahead of the game.

We already know that the Berenberg banking dynasty, the oldest merchant bank in the world, originated from the Hanseatic League. Their rise in wealth and power was partly due to their cooperation with the German-British Barings Bank; once known as the “6th Great Power of Europe”.

If the Berenberg’s were able to transform their enterprises into banking, forming one of the largest London banks in history, is it possible that other Hanseatic trading houses followed suit?

The Forgotten Majority

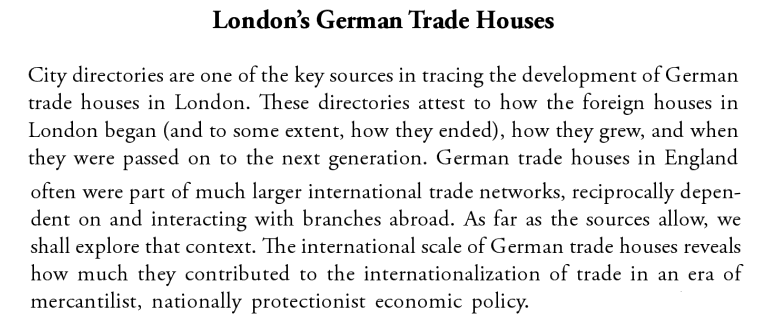

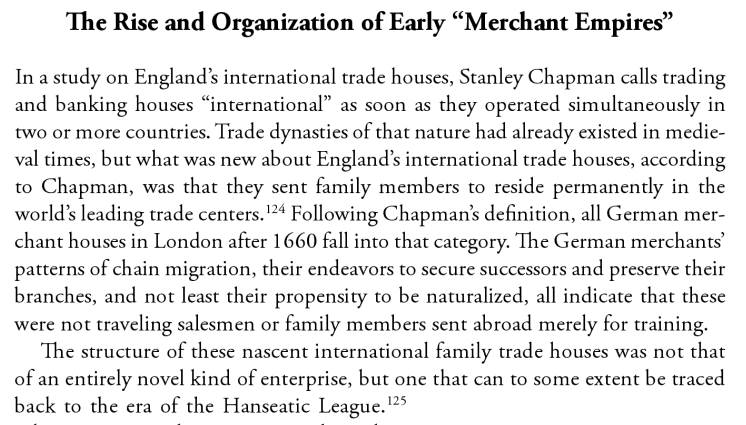

The “forgotten majority” of German merchants in London between the end of the Hanseatic League and the end of the Napoleonic Wars became the largest mercantile Christian immigrant group in the eighteenth century. Using previously neglected and little used evidence, this book assesses the causes of their migration, the establishment of their businesses in the capital, and the global reach of the enterprises. As the acquisition of British nationality was the admission ticket to Britain’s commercial empire, it investigates the commercial function of British naturalization policy in the early modern period, while also considering the risks of failure and chance for a new beginning in a foreign environment. As more German merchants integrated into British commercial society, they contributed to London becoming the leading place of exchange between the European continent, Russia, and the New World.

If it was not for this fascinating book outlining the naturalization of German families into England, the conventional story of the demise of the Hanseatic League is believable. The Forgotten Majority, however, provides facts and figures that illuminate a very different possibility.

So far, we have shown how some of the most powerful families in Europe derived their wealth from trade, commerce, eventually morphing into banking dynasties. For nearly 500 years, the merchant families of the Hanseatic League dominated the economic landscape of Europe. It appears they did not disappear at all. Instead, they moved to London:

Moving from Germany to London could only be achieved by the wealthy and the well-connected. Far from a one-off mission, wealthy German merchant families developed a system of multi-generational migration:

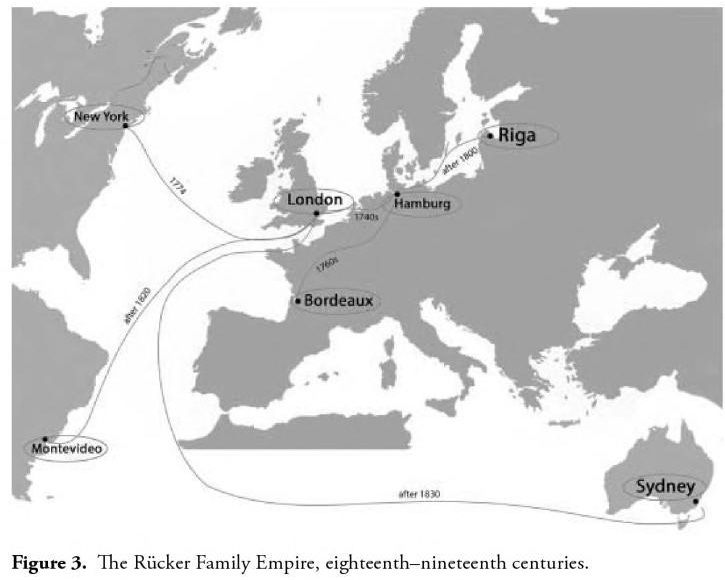

There are overwhelming records of German merchant families sending their own to England, whereby they expanded their trading enterprises and eventually became naturalized English citizens. Voguell, Amyand, Siebel, Steinman, Amsinck and Rucker are just a few. The Rucker’s became one of the most successful trading houses in England.

In order to become less obvious, many naturalized Germans began to “Anglocize” their surnames and disappear into British society. This activity was not the work of a bunch of desperate German migrants seeking a better life. This was perhaps the most sophisticated and innovative infiltration of a nation ever undertaken, by the wealthiest merchants of the day. The Hanseatic League never died, it simply transformed:

Merchant families of the Hanseatic League became the “forgotten majority” in the history of Britain. Their wealth and innovation in trade and finance ensured London became the pre-eminent trading center of the world:

With evidence that the Hanseatic League was now the “invisible enemy”, we are compelled to explore how far German nobility may have penetrated Britain?

The Oranges of the Glorious Revolution and the Bank of England

“The Forgotten Majority” compiles records of German immigration into England from 1660. It is hard to ascertain the scale of migration of Germans before this period, however it is reasonable to assume that some wealthy German merchant families of the Hanseatic League were in England before 1660.

To what extent did this migration influence the future of Great Britain?

The imposition of a ‘standing army’ is notable, as it was a staunch Prussian tradition. Britain was slowly mobilizing into a Prussian structure. The chaos that was engulfing Britain throughout the 17th century led to the bloodless Glorious Revolution of 1688,which saw the accession of the Prince of Orange, William III and Mary II to the English throne.

Notably, about 40 years prior, the Prussian Hohenzollern family became consolidated with the House of Orange, via marriage:

“The royal families of the Hohenzollern and Orange have been connected to each other by marriages since 1646. Wilhelm II was therefore allowed the title Prince of Orange.

Portraits can be found in both the vestibule and the library of Friedrich Wilhelm von Brandenburg (1640-1688), also known as the Great Elector, and his wife Louise Henriette of Orange-Nassau. Friedrich Wilhelm von Brandenburg was the first Hohenzollern to marry a Princess of Orange. Louise Henriette of Orange was a daughter of Frederik Hendrik, Prince of Orange, a son of William of Orange. Over time, the link between these two royal families was consolidated by further marriages…”

The reign of William of Orange lasted until 1702. During his reign he managed to establish one of the most significant institutions in British history; the Bank of England:

The loan of 1.2 million pounds comprised of a list of shareholders who pledged capital to the bank. How many of these were descendants of German merchants, we may never know. What we do know is that the great expansion of the British Empire took on new vigour once the Bank of England was established.

When William III of Orange died in 1702, the reigns of power would go to Queen Anne. However, prior to her arrival, a world-changing Act was passed into law, completing the reign of the Prince of Orange:

From that point on, German nobility have held the British Crown.

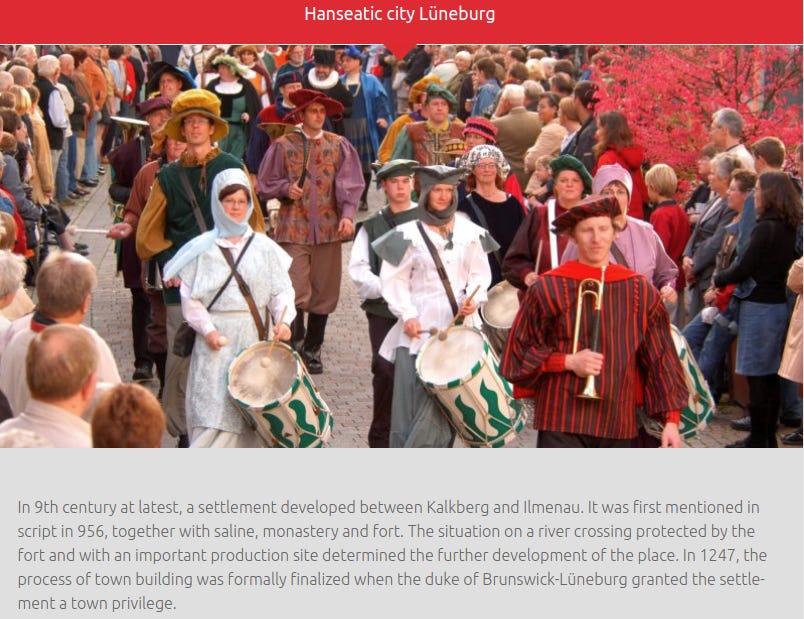

The House of Hanover was an extremely powerful noble family in Germany. They presided over the cities of Brunswick (Braunschweig in German) and Luneburg, which were both powerful Hanseatic trading centers:

During the 18th and 19th centuries, Britain morphed into the most powerful economic, maritime and colonial power of the era. All of this was achieved under the watchful-eye of a monarch with heritage to the Hanseatic League and the Bank of England, established by William of Orange.

When the Hanover dynasty lost control of the British Crown, they were replaced by the House of Saxe-Coburg-Gotha. In the Not Since 1917 series, we showed that in 1917 the Crown quietly changed their name to the House of Windsor. More important were the Crown’s family ties to the Hohenzollerns; the kings of Prussia, the Emperors of Germany, and the princes of Orange:

Becoming Prussian

During the 12th Century, the Holy Roman Empire granted certain privileges and rights that changed the world forever. The notable recipients were the Hanse and the Hohenzollern regions:

- The Hanse cities received exemptions and privileges from the Holy Roman Emperor with respect to trade. The Hanseatic League began to form, and by 1226, Emperor Frederick II granted them the status of “Imperial free cities”.

- Emperor Henry VI, Frederick II’s father, had earlier granted the House of Hohenzollern their first noble title, in 1192. They were known as the Burgraviate of Nuremberg.

The rise of the Hanseatic League was beyond anything seen before. The monopolization of Baltic trade afforded them imperial-like power. Any kingdom that argued with their terms of trade would find themselves cut off from the supply chain and plunged into depression and famine, before being attacked by the Hanseatic military. The League proved that those who control trade, hold the power.

It is alleged that the 1666 Great Fire of London destroyed the Hanse Steelyard, marking the end of the Hanseatic League. However, #PrussiaGate contends that not only did wealthy German merchant families continue their pattern of systemic chain migration and naturalization into England, but established some of the most powerful trading houses in London.

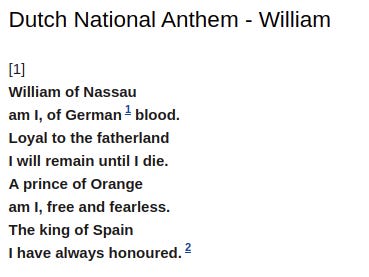

Only a few decades after 1666, William III of Orange took over the British Crown in the Glorious Revolution. He was a Dutchman by birth. If there is any doubting where the loyalties of the House of Orange lay, the Dutch national anthem provides clarity:

William presided over the establishment of the Bank of England and also ensured that the British Crown would forever more remain in German hands. The ruling House of Hanover had originated from two powerful Hanseatic city states; Brunswick-Luneburg.

The most successful German trading houses would ultimately become banking oligarchs. The Ruckers, Rothschilds, Barings, Schroders, and a host of other families dominated the British banking scene. In coordination with the British Crown, the Bank of England and the mercantilist East India Company, Britain experienced a trading boom and gained military and economic supremacy throughout the world.

The mercantilist practices of the British Empire were eerily reminiscent of the Hanseatic League, centuries before. Given the level of infiltration we have thus far presented, this should not be surprising. However, their mercantilist oppression was upended when a group of colonialists on the other side of the Atlantic discovered the meaning and value of, “life, liberty and the pursuit of happiness”:

Regardless, most of the Western world’s trade was in the hands of the British and Dutch empires, financed and controlled by private banking houses and central banks. Almost all of these entities appear to have originated from, were controlled by, or loyal to, the houses of German nobility. The Hohenzollerns would soon be placed at the top of all German nobility.

Around the same time the Hanseatic League disappeared from public view, the Hohenzollerns began their meteoric rise to power. After Otto von Bismarck’s famous ‘Blood and Iron’ speech, Prussia embarked on the unification of Germany:

- The first war conquered Schleswig-Holstein, seizing the original capital of the Hanseatic League – Lubeck.

- The second war defeated Austria-Hungary and with that they annexed Hanover.

- The third war crushed France, united the rest of the German provinces behind Prussia, and in 1871 Wilhelm I was crowned the Emperor of Germany at the Hall of Mirrors in Versailles.

All German houses were now loyal to the Emperor, the king of Prussia and prince of Orange.

When we consider the British and Dutch monarchs, the private banking oligarchs, and particularly the global network of central banking that has taken control of the world’s money supply, the crowning of Wilhelm I in 1871 is more significant than we perhaps realize.

As we have shown previously, much more happened in 1871, which all served to empower the German Emperor.

When Paul Warburg arrived in America in 1897 and embarked on a successful mission to install the US Federal Reserve, the Prussification of America was completed.

As we look around today we see a world flooded with central bank debt, a complex matrix of globalist corporations, and a Swabian-based ReichsWEF openly touting and coordinating the destruction of humanity and their natural rights to freedom. We cannot but help look in awe at history and the Hanseatic League that preceded it.

If the Hanseatic merchant dynasties became invisible and took control of global trade through centralized banking, anointing Prussia as their invisible leader, we may be getting very close to discovering the ‘oranges of the investigation’.

https://www.belfercenter.org/thucydides-trap/overview-thucydides-trap

https://portlandctgreece.weebly.com/spartian-economy.html

https://portlandctgreece.weebly.com/athens-economy.html

https://carthagemagazine.com/carthaginian-trade-routes-of-ancient-carthage/

https://www.shorthistory.org/ancient-civilizations/ancient-rome/rome-and-carthage-compared/https://www.nam.ac.uk/explore/british-civil-wars

https://mariamilani.com/ancient_rome/rome_economy.htm

ibid

https://www.ancient-origins.net/history-famous-people/khazars-0011246

https://www.jrbooksonline.com/PDF_Books/13tribe.pdf , pg 1

https://www.jrbooksonline.com/PDF_Books/13tribe.pdf , pg 7

http://www.khazaria.com/khazar-history.html

https://www.jrbooksonline.com/PDF_Books/13tribe.pdf , pg 35

https://www.jrbooksonline.com/PDF_Books/13tribe.pdf , pg 29

https://epicworldhistory.blogspot.com/2013/07/hanseatic-league.html

https://epicworldhistory.blogspot.com/2013/07/hanseatic-league.html

ibid

ibid

https://www.ancient-origins.net/ancient-places-europe/hanseatic-league-0013886

https://mark-patton.blogspot.com/2016/03/the-wards-of-old-london-dowgate.html

https://en.wikipedia.org/wiki/Hanseatic_League

https://www.hanse.org/en/hanse-historic/the-history-of-the-hanseatic-league/

https://stolenhistory.net/threads/the-hanseatic-league-who-were-they-really.1632/

https://history.state.gov/countries/issues/german-unification

https://www.dailyhistory.org/How_did_the_de_Medici_contribute_to_the_Renaissance

https://www.edology.com/blog/accounting-finance/3-medici-banking-innovations/

https://www.duhocchina.com/wiki/en/berenberg_family

ibid

https://air.iuav.it/handle/11578/312536?mode=full.545

https://www.thoughtco.com/history-of-venice-1221659

https://de.zxc.wiki/wiki/Preu%C3%9Fische_Bank

https://www.investopedia.com/updates/history-rothschild-family/

https://www.jewishencyclopedia.com/articles/12909-rothschild

Beerbühl, M. S. The Forgotten Majority. Berghahn Books, 2014. p 87-88

Beerbühl, M. S. The Forgotten Majority. Berghahn Books, 2014. p 95

Beerbühl, M. S. The Forgotten Majority. Berghahn Books, 2014. p 97

Beerbühl, M. S. The Forgotten Majority. Berghahn Books, 2014. p 107

Beerbühl, M. S. The Forgotten Majority. Berghahn Books, 2014. p 248

https://www.nam.ac.uk/explore/british-civil-wars

https://www.huisdoorn.nl/en/wilhelm-ii/the-hohenzollern-dynasty/hohenzollern-and-orange-family/

https://moneyweek.com/402300/27-july-1694-the-bank-of-england-is-created-by-royal-charter

https://www.ancient-origins.net/history-famous-people/house-hanover-0013792

https://www.ancient-origins.net/history-famous-people/house-hanover-0013792

https://www.hanse.org/en/hanseatic-cities/braunschweig/

https://www.hanse.org/en/hanseatic-cities/lueneburg/

https://medium.com/lessons-from-history/king-george-vs-darkest-secret-e9d50987d30f

https://lyricstranslate.com/en/dutch-national-anthem-wilhelmus-dutch-national-anthem-william.html

https://stolenhistory.net/threads/the-hanseatic-league-who-were-they-really.1632/