Part 3 looked at the 1871 Treaty of Washington and its contribution to the development of international law, the United Nations and the myriad of supranational entities associated with it.

Part 4 will analyze the financial legacy of the treaty. The core premise of #PrussiaGate is that Prussia is not a nation, but an army that controls nations. After two catastrophic world wars, Prussia disappeared from the world diplomatic stage, and became invisible. This invisible army transformed into a battalion of globalist corporations and central banks, and embarked on a mission to secure the world’s resources and supply chains. These corporate entities are now highly-coordinated and operating in lockstep with self-declared psychopathic elites from the World Economic Forum (aka the ReichsWEF). They are joined by other maniacal think tanks such as the Bilderberg Group, Bohemian Grove, Council on Foreign Relations, and other globalist conferences. During these get-togethers, bankers, CEOs and fake hedge fund managers also get to dabble in their favorite fetishes to “destress” after a hard days work discussing their cult-like obsession with global depopulation.

Recall in Part 1 we showed how King Charles II sent his kingdom bankrupt with his insatiable appetite for wars and whores. Today, as the world appears on the brink of total collapse, wars and whores are back on the agenda for the globalist psycho-elite. The burden of these fetishes falls squarely on the shoulders of We the People, in the form of gargantuan public debts, rising prices and increased taxation.

In many ways, the 1871 Treaty of Washington served as a blueprint for the predicament we find ourselves in today.

This is the story of the world’s most ruthless and successful hedge fund.

Bismarckian Politik

Perhaps the greatest statesman of the 19th Century was the Prussian Chancellor, Otto von Bismarck. The strength, power and pragmatism that Bismarck brought to the world’s diplomatic stage changed politics forever. There was a lot to admire about this man:

Unfortunately, and despite his understanding of a man’s best friend, Bismarck was a loyal servant of Prussia; from the cradle to the grave. Therefore, all his actions were about the rise of Prussia, and nothing else. If he believed that America could compete with Prussia at any point in time, Bismarck and the Prussian nobility would view the United States as an enemy that needed to be brought to heel.

Bismarck is known as the founder and master of Realpolitik. For Bismarck, this entailed a completely pragmatic approach to the expansion of Prussia’s power. Even the most despicable acts were on the table if they aided and abetted the rise of the Prussian Empire.

During the German Unification Wars, Bismarck was a master statesman. However, behind the scenes, he made use of the most elaborate espionage network in the world. Stieber, his chief of secret police, or Gestapo, spent the entire war period coordinating enormous numbers of agents throughout Europe.

“Bismarck and Stieber were for long engaged in conversation….the appointment of over 1000 spies within the invasion zones with “head-centres” at Brussels, Lausanne and Geneva..……the sending of several thousands of female employees for service in public places as barmaids or cashiers……in pursuance of Stieber’s plans, some 13,000 German spies of the minor order were asked for……Between that year and 1870, Stieber had added at least 20,000 more, all of them scattered in various kinds of capacities along the routes of intended invasion from Berlin and Belgium to Paris.”

Even Stieber was aghast at the depth of intelligence which Bismarck possessed. When Stieber reported about a planned assassination attempt on Tsar Alexander II, Bismarck explained he already knew about it, and requested Stieber allow the plot to unfold.

As Bismarck explained to Stieber, “we must allow this act to be attempted and for political reasons”.

Like Frederck the Great a century prior, there was nothing happening in the world that Bismarck did not know about. His Realpolitik worldview, his intelligence gathering, and the subsequent events that occurred around the world, had one sole purpose; everything must serve the rise of Prussia.

There was potentially nobody on the planet at the time who possessed a clearer vision of the fate of America than Otto von Bismarck. After all, not only was his espionage network scattered throughout the world providing him with key intelligence information, his private banker was an integral part of “the high financial powers of Europe”.

When it came to Bismarck’s investment portfolio, Gerson von Bleichroder was his go-to financial man.

Bleichrodian Economiks

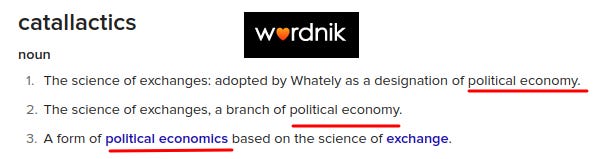

The financial markets are the frontiers of humanity, and will forever remain so. From the moment humans performed their first barter trade, a price for a good, service or labor was established.

If a silo of corn can be exchanged for a barrel of whisky, a price has been established for both goods. If a prostitute in Davos is paid $2500 for their skillsets, a price has been established for their labor. Prices act as signals, and compel people to act and transact with each other based on the price signals they receive. Our actions and transactions drive our behaviour, and when viewed collectively, we call this a society, a civilization, or an economy.

This concept holds true whether you are a communist, a capitalist, or a caveman. It is termed “catallactics”.

If there was anyone who could apply Bismarck’s principles of Realpolitik to the financial markets, and the field of catallactics, it was his private banker, Gerson von Bleichroder:

Bleichroder and Bismarck were financially inseparable. When America descended into Civil War, Bismarck undoubtedly knew everything that was happening on the ground, mainly because there were ex-Prussian officers serving on both sides of the conflict. In the world of finance, Bleichroder would have the inside-mail on the money-lending cartels; mainly the German-British banks residing in the City of London. The combined knowledge and influence of Bleichroder and Bismarck was monumental.

Bleichroder’s financial connections were probably how Bismarck learned that the bankers were going to skew their financial assistance, and divide “the United States into equal federations of equal force”. It also explains how he understood the game-plan for the bankers after the conflict; which was to milk America for everything it was worth, starting with the full repayment of Civil War bonds.

The philosophical and financial partnership of Bleichroder and Bismarck set the stage for a series of investments in America that would place its people under the control of multinational corporations, banking cartels, and the City of London.

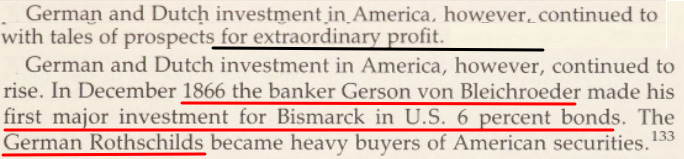

Bismarck, forever the pragmatist, had no interest in rescuing America from its predicament. Instead, he and Bleichroder decided to profit from it:

Forging the “Bond”

In Part 2 we showed how the North were effectively blocked from international finance, but the South were issuing bonds in Europe with tremendous success. This forced Lincoln and his Secretary of Treasury, Salmon P. Chase, to domestically issue over $2.3 billion in US government bonds. After the war, the prices of these bonds collapsed.

What this meant was that if the US government did not default on their Civil War debt, there was a huge profit to be made when America eventually “paid up”.

America was up to its eyeballs in debt, and its economy was being flooded with fiatcurrency. In 1866, with Lincoln recently assassinated, the United States could not have been in a weaker position. While all of this was transpiring, Bleichroder and the Rothschilds were advising their clients to snap up American Civil War bonds, because the eventual pay-day would be huge.

However, there was just one problem – the US had discovered the treachery of Britain during the Civil War years. In 1866, the 14th Amendment was submitted to the states for ratification. The Public Debt Clause sent shivers down the spines of US government bond investors.

In Part 3, we presented what would have happened if the “Alabama Claims” were handled using the Public Debt Clause in the US Constitution. A wave of selling would have occurred instantaneously, and the bonds would become practically worthless. If this happened, Bleichroder, Bismarck and the Rothchild’s investment portfolios would have taken a nasty hit.

Under no circumstances could the 14th Amendment be invoked. Bismarck, Bleichroder, and the entire money-lending cartel in the City of London, were activated, in lock-step.

Preparing for 1871

When the 14th Amendment circulated in 1866, it was extremely controversial. For the international bond traders, it represented a potential disaster. To understand what transpired in the lead up to the 1871 Treaty, we must follow the money.

Bleichroder and Bismarck had connections all over the world. Bleichroder was Prussia’s “mover and shaker” in the global financial world. To ensure the US government was going to make the right financial decisions, high level German bankers began to migrate to America; more specifically, to Wall Street.

After the 1848 Communist revolution in Europe, Abraham Kuhn and Solomon Loeb fled Germany for America. Abraham married Solomon’s sister, and Solomon obliged Abraham by marrying his sister. They made their initial fortune selling uniforms to the military during the Civil War.

Despite living in the US, both men remained heavily connected to Germany. German bankers became intertwined with the finances of Kuhn and Loeb, particularly the Schiff and Warburg families. Jacob Schiff married Solomon Loeb’s daughter, as did Felix and Paul Warburg with Solomon’s other daughters, who were, of course, also the daughters of Abraham Kuhn’s sister. Got it?

Just one year after the 14th Amendment circulated, Abraham and Solomon set up a bank in New York; Kuhn, Loeb & Co.

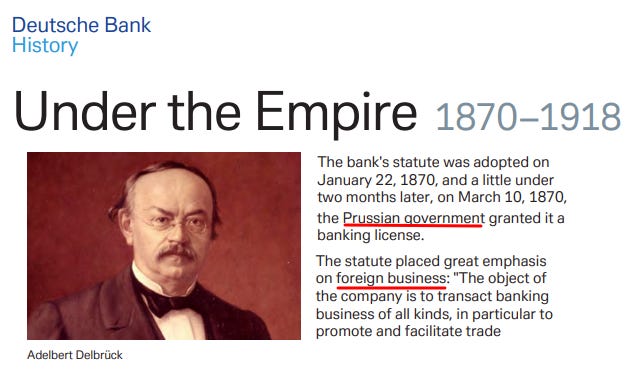

Kuhn, Loeb & Co. grew to become one of the most powerful banks on Wall St., and the world. They would also evolve to become a powerful financial vehicle for the German Reich. The ‘Warburg’ name should be familiar for regular #PrussiaGate readers. The family has played a dominant role in America’s financial history. The other notable bank in this story, was the purpose-built Deutsche Bank:

It is important to note that while Deutsche Bank’s statute was about facilitating foreign business for Germans, they chose to have a “silent presence” in New York. The reason for this is simple; a Prussian state-endorsed bank on Wall St. would arouse suspicion, and their activities would attract constant scrutiny. Interestingly, Deutsche Bank chose to act publicly in Bremen, Shanghai, Yokohama, Hamburg and London; everywhere except on Wall St.

The German Reich was steadily moving into Wall St, just as the Hanseatic League had done with the City of London centuries before. With so many Germans invested in America’s debt, it was time to ensure the nation got back to business, and pay their debts – with interest, and in gold and silver.

To achieve this, the pain of the Civil War had to be released so that America could rise from the ashes, and make some money.

Pay Day, 1871

The financial ramifications of the Treaty of Washington 1871 were vast. As soon as it was signed and an international court was convened in Geneva, global bond investors rejoiced. The arrogance of the banking cartel was on full display:

The refinancing of America’s debt in London was designed to attract as many new investors as possible. The Rothschilds, Barings and Bleichroders were all promoting US government debt as an attractive, safe, and reliable investment.

However, these guys were not particularly interested in themselves being long-term holders of US government bonds. Their intentions were always to get out as soon as the profit was realized. Once they convinced their clients that US government bonds were now “safe and reliable”, yields on the Civil War bonds plummeted. This meant the price of the bonds soared. For players like Bleichroder, Bismarck and other investors, a tremendous fortune had just been secured.

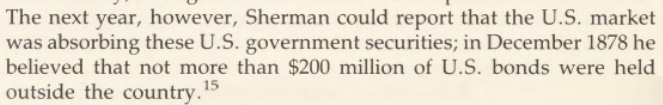

By the early 1870s, most of the original foreign investors in Civil War bonds had sold out of their positions. By 1878, most of the US bonds had been sold by foreigners, back to Americans:

Let’s take a moment to summarize the situation:

- Lincoln and Chase issued over $2.3 billion in US government bonds during the Civil War;

- After the war, these bonds traded at a huge discount because of the uncertainty of America’s ability to repay the debt, and the possibility it could cancel a large portion of that debt due to the Public Debt Clause in the 14th Amendment;

- After the war, many Prussians, including Bismarck, bought these bonds hoping to make a fortune, banking on America’s ability and willingness to repay the debt in full;

- When the 1871 Treaty of Washington was signed, the value of the bonds increased dramatically, generating huge profits for the original investors;

- In 1871 and 1873, the US government refinanced their debts in the City of London, and the ensuing bonds were sold back to American investors, thereby locking in the profit for Bismarck, Bleichroder and everyone else who got in on the trade during the mid-1860s.

There was some serious coin being made during this period. With so much money floating around in the hands of the Prussians and the City of London, the main question was what do with it all.

The Great Reinvestment

The Civil War debt was an enormous burden for the American economy. At the time, the only revenue for the federal government was via tariffs and excise taxes. Now that the nation’s finances were re-organized in the City of London, it was time for America to reach its full economic potential. With an abundance of natural resources, energy and cheap labor, an economic boom was on the horizon:

The American Industrial Revolution was perhaps the most important economic period in American history. The nation was operating without a central bank, and the hard-money advocates were ferociously fighting to keep a specie-backed currency. Hard work, innovation and entrepreneurial risks could transform the average person out of poverty and into riches. Real wages exploded, allowing the middle class to participate in the greatest wealth-creation period in history.

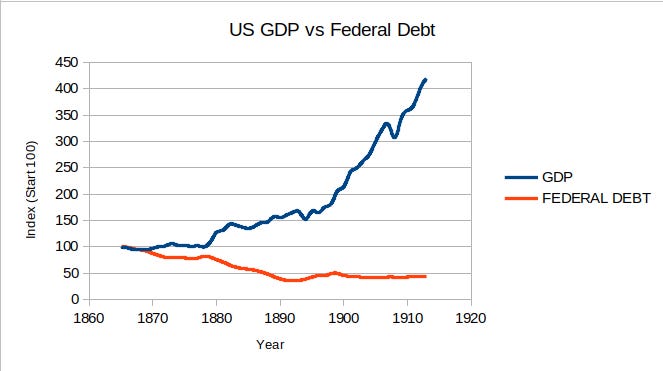

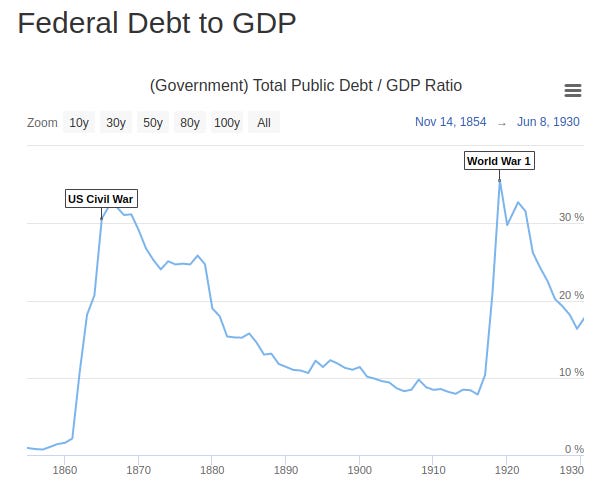

From 1875 – 1914, the American economy grew so dramatically that the burden of Civil war debts became relatively insignificant:

The federal debt was cut in half, while GDP quadrupled. While the middle class prospered during this period, the serious money was made by those with capital investments in the great American boom.

For Bismarck, Bleichroder and the City of London, the huge profits realized from the Civil War bond trade needed to go somewhere. They were funnelled into America’s railroads, mines, factories, and banks.

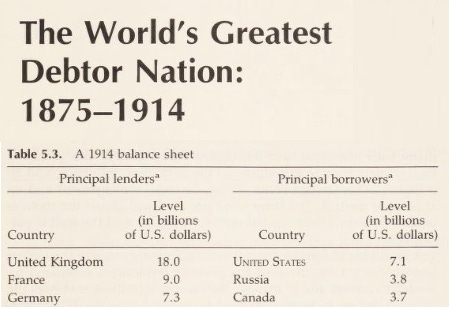

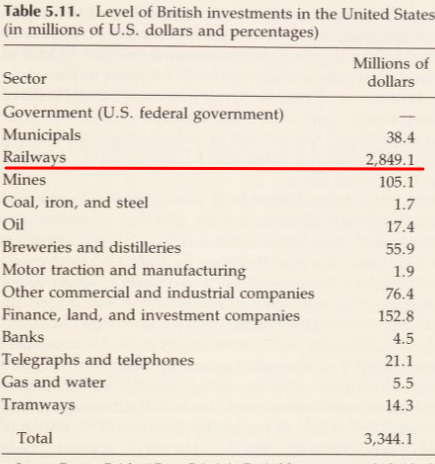

This was the “Great Reinvestment”. By 1910, the British had no interest whatsoever in US government bonds; they were child’s play compared to the wealth generated from American railroads:

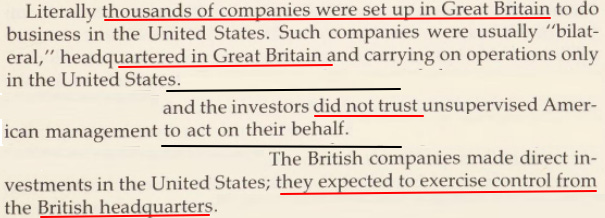

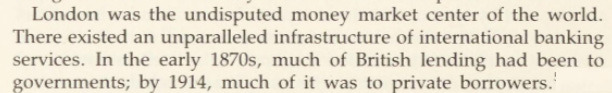

After the 1871 Treaty of Washington, Britain and Germany were the two biggest investors in America. The British set up special purpose vehicles (SPV), to secure their part of the American dream:

Britain was not the only nation setting up holding companies to own and control assets in the United States and around the world. The Dutch, Germans and French were also big players in that field. This marked the birth of globalist multinational corporations, and these private companies were securing America’s resources, and supply chains.

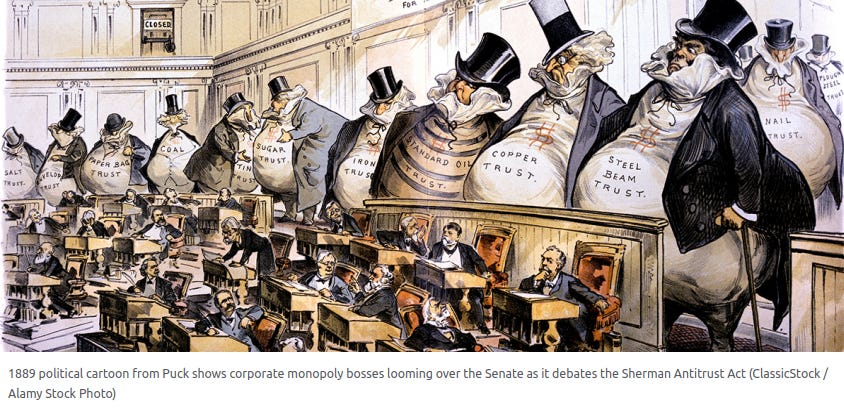

None of this was possible without international funding, and the City of London was only too happy to oblige:

The cozy relationship between the City of London bankers and multinational corporations was extremely powerful. Monopolies evolved throughout America, and the world, as the bankers provided finance for the biggest corporations, who in turn used the money to buy-out or destroy their competition. The power of these monopolies did not go unnoticed, and some federal politicians vowed to “Trust Bust” them into oblivion.

Infiltration, Instead of Invasion

By 1910, approximately $7 billion in America was long-term foreign investment. This represented approximately 20% of GDP, predominantly from Britain and Germany. However, these figures are most likely underestimated, because the strategy used by Germany to invest in the American boom was very different to the British, as we will show.

Recall the tactics used by Bismarck as one of the world’s great diplomats. War was never undertaken until Bismarck had ascertained a complete picture of the enemy’s military and financial positions. This was achieved via an army of spies, carefully placed throughout the world. Since Bismarck and Bleichroder were inseparable, the same rigor would have been applied with respect to Prussian capital investments.

At this stage, we must distinguish between German nobility and the German middle class. While the German Reich had a constitution and a parliament, the true political power remained in the hands of German nobility. As #PrussiaGate readers are acutely aware, the average German citizen was indoctrinated into worshipping the state. They were heavily taxed, and compulsory military service was the unquestionable order of the day.

This is important to note because not every German was enjoying life in the Prussian autocracy. An unprecedented wave of German migration occurred during the industrial revolution:

Almost all the Germans coming to America during this time were in search of a better life and wanting to participate in the economic boom. The Trump family were among them:

Many Germans were simply migrating to America and becoming a part of the American social fabric. However, the uber-wealthy German nobility were not particularly interested in just participating in America’s economy. Instead, they wished to profit from it, and control it; just like the British, but in a much more covert fashion.

Recall that Deutsche Bank was granted its Prussian charter in 1870 with the explicit mandate to facilitate all kinds of foreign transactions on behalf of the German Reich. It became the commercial bank for the Reich, and all the corporations that were loyal to Germany. In 1867, Kuhn and Loeb founded their bank, and attracted Germans such as Jacob Schiff, and later Paul Warburg. These men were of German origin, but their banking enterprise was considered American, because they had been granted US citizenship.

Many Germans who came to America also became naturalized citizens. This makes it exceptionally difficult to ascertain the extent of German ownership of private capital in the United States during the industrial revolution. However, what can be determined is how German corporations operated in America at that time:

This meant that American companies essentially became salesmen for German corporations. Since German companies owned or controlled the patents, the profits from American companies would be siphoned back to Germany as royalties. Therefore, German corporations completely controlled their American subservient partners.

German companies also established cartels, which aimed to monopolize certain parts of the American supply chain:

The ‘Potash Cartel’ was just one of many German cartels seeking control over American resources and supply chains. They were known as “seller’s cartels”, and it was not just limited to the fertilizer industry. German corporations were gradually cornering the market within key American industries, particularly in drugs and chemicals.

This marked the birth of globalist industrial complexes in chemicals and pharmaceuticals.

For Germany, the success of the cartels in America, and throughout the world, was immense. It laid the foundations for the formation of the ultimate German cartel – I.G. Farben.

Germans were far more opaque when it came to their investments in America. German-born Americans controlled many American corporations. Controlling patents transferred the profits generated from American companies to German ones. Similarly, Kuhn, Loeb & Co. was an American bank, founded and controlled by German-born Americans, and became one of the most influential banking houses in New York. All these transactions were facilitated by the Prussian-endorsed Deutsche Bank, who chose to participate in the American banking system as a “silent partner”.

Business for Deutsche Bank exploded, and they needed to rapidly expand their operations. German banker, Otto Hermann Kahn, was sent to the London branch of Deutsche in 1888. He would eventually become known as the “King of New York”, and moved to New York to facilitate the enormous financial transactions between Kuhn, Loeb & Co., Deutsche Bank, the Warburgs and the ‘seller’s cartels’.

When one truly understands the power wielded by the German-banking firms in New York by players like Warburg, Schiff, Kuhn, Loeb, Rothschilds, and the “King of New York”, one is compelled to wonder if President Trump was providing a clue about a particularly famous Trump faux pas:

The incredible rise of America from 1875-1914 occurred without a central bank, and with a currency that was linked to gold and silver. However, with 20, 30, or perhaps even 40% of the nation’s economy controlled through New York and the City of London, the true power lay with the banking cartels and various other monopolies.

Things were about to change; bigly.

The Prussian Origins of The U.S. Federal Reichsbank

In our article with the above title, we presented a detailed timeline leading to the establishment of the private central bank – the US Federal Reserve. The main banker behind this plan was German-born Paul Warburg. Paul married the beautiful Nina Loeb, the daughter of Solomon Loeb and Fanny Kuhn. Since the Warburg family banking firm, M. M. Warburg & Co, had already formed a strong partnership with Kuhn, Loeb & Co, this marriage was a match made in banker heaven.

https://truthtrench.org/?p=3655

Paul moved from Germany to New York, and in 1902, more than ten years before the incorporation of the bank, Warburg made his plans to the world very clear:

From 1875 – 1914, the great industrial revolution saw the largest wealth increase in world history. This was achieved without a central bank, hard-currency or income tax. According to Paul Warburg, this incredible achievement was all bullshit. In his mind, it was time to introduce income tax, and a Prussian central banking model.

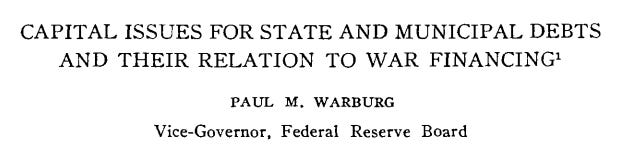

Warburg is known as the “architect of the Federal Reserve”. His creation was a central bank modelled on the German Reichsbank. He was one of the Federal Reserve Board’s original members. In 1916, he became the Vice-Governor of the Federal Reserve, just in time for America’s entry into WWI.

The Real-Ekonomik of World War

We must sincerely thank #PrussiaGate reader,”

Some thoughts to clear my head

“, for pointing us to an incredible book. This 1917 publication illuminates the mindset of Kaiser Wilhelm II:

This is a fascinating read, and it has numerous references to “Alice”, or Alix. She was a German Princess that the Kaiser set up to marry his cousin, Tsar Nicholas of Russia. Alice was secretly loyal to Germany, and was therefore a Russian traitor, who worked tirelessly to destroy the empire from within. This pleased the Kaiser immensely who, as we know, had sent Vladimir Lenin to Russia in 1917 with his money and his blessing. Once the Bolsheviks took control of the Russian empire, the Kaiser’s cousin and the whole Romanov family were machine-gunned to death in a concrete basement.

At this point, some may be wondering: “Alice? Who the f**k is Alice?”. While this is very intriguing, more importantly, the book outlines the true intention of the Prussian Kaiser’s worldview at the time:

This was in the early 1900s. Make no mistake, the German Reich was preparing for a world war long before the first shots were fired:

- There were the letters between the Kaiser and Tsar Nicholas.

- There was the Schlieffen Plan; a decades long military plan for Germany to take over Europe.

- There was also Dragutin Dimitrijević, the ex-chief of military intelligence in Serbia, who spent time studying “the latest military programs” in Berlin, in 1906. Dragutin would eventually lead a paramilitary group in Serbia called the “Black Hand”. Their logo was the infamous Totenkopf, or “Skull and Bones”, that was used by Prussia’s cavalry unit. Dragutin’s group were responsible for the assassination of Archduke Ferdinand, which put WWI into hyperdrive.

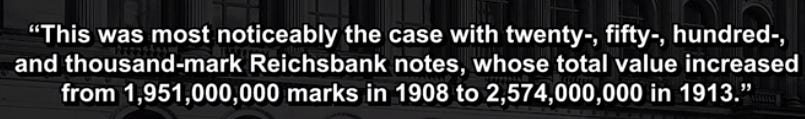

However, perhaps the greatest smoking gun relating to Germany’s pre-meditated push toward World War I, were their preparations to finance their future military campaign. They began debasing their currency, well before the assassination of Archduke Ferdinand:

Well before 1914, the German Reich embarked on a campaign to bolster their central bank with as much physical gold as possible. As we have presented numerous times in this series, gold and silver are ultimately what is needed to finance a war. To this end, the Kaiser and his Prussian military men were accumulating gold and silver, from their own citizens. The German people were being thrown under the bus:

What this really meant was that Germany was printing paper-money before the war in order to build up its military forces. At the time, Germany’s currency was on a “gold standard”. However, the paper-money, known as the “paper Mark”, was printed without any real gold-backing, despite being declared “as good as gold” for use as legal tender. Therefore, the German people were being forced into using fiat currency, in order to benefit the Prussian-controlled military.

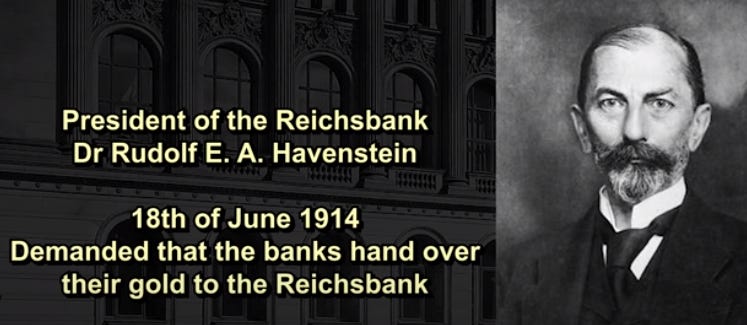

Perhaps the most damning evidence of financial planning by the Reich was carried out by the head of the Reichsbank:

This was a drastic move by Rudolf, effectively emulating the “forced loan” by King Charles I back in the 1600s. It was also 10 days before Archduke Franz Ferdinand was assassinated.

With the king of Prussia appointed as Kaiser, Prussian nobility advising the military, and a Prussian banker in charge of the German Reichsbank, Germany was ready for a world war, and world domination.

The assassination of the Austrian Archduke provided a perfect smokescreen to justify war. Germany was prepared for this assault on Europe; militarily and financially.

To the Spoils of Battle

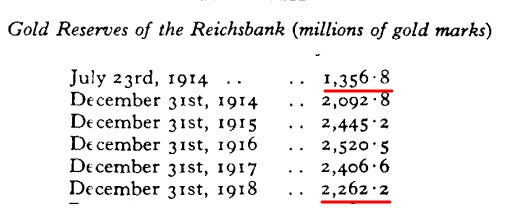

It is hard to disregard the war crimes, the dead bodies, the broken families, and damaged souls from the catastrophe that was the Great War. Using the Bleichroder principle of RealEconomik, let’s look at this from the viewpoint of a globalist money-lender, where gold is money, and everything else is credit. Wars cost money; lots of money. How did the German Reichsbank fare after years of trench warfare?

Incredibly, the German Reichsbank nearly doubled their gold reserves during the war. Also, consider that the Kaiser provided serious amounts of bullion to Vladimir Lenin, supporting his quest for a Bolshevik Russia. Even a Marxist like Lenin understood the value of real money.

The Reichsbank secured quite a tidy profit indeed.

The debasement of Germany’s currency before World War I began a chain of events that eventually led to the Weimar Republic and hyperinflation, which we outlined in our Not Since 1917 series. The German people were destroyed, and their resources and supply chains were snapped up by globalist corporations, for pennies on the dollar.

How did America fare throughout the war?

Before we analyze this question by “following the money”, we must first look at a few events that led to America’s entry into the war against Germany, in 1917.

The first point is that war was declared by the United States after the discovery of the infamous “Zimmerman Telegram”. This was a coded telegram that was intercepted by British Intelligence. In the telegram, the German Foreign Secretary proposed a military alliance between Mexico and Germany. If Mexico attacked America from the Southern border, Germany would support the attack, and Mexico could annex Texas, New Mexico and Arizona.

Did Germany’s plan backfire, or was there something else in play to get America invested in the war?

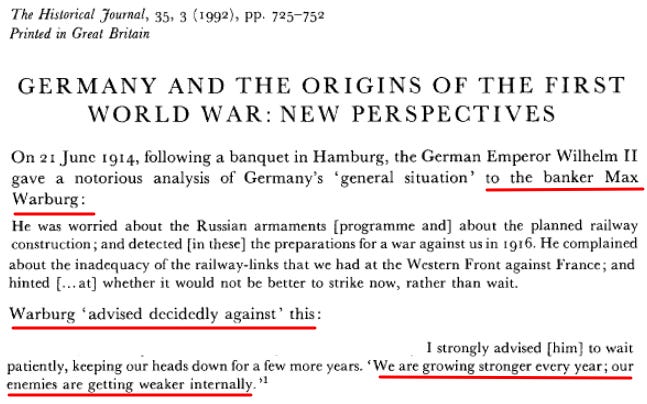

Another interesting facet to America’s entry into World War 1 relates to the brother of the man who founded the Federal Reserve; Herr Max Warburg:

Why was Max Warburg advising the Kaiser on preparations for war, especially when their meeting on the subject was a week before Archduke Ferdinand was assassinated? Just who, exactly, were the enemies of the German Reich at this time? Just what did Max mean when he stated “our enemies are getting weaker internally”? After all, not even six months prior to the meeting between the Kaiser and Max Warburg, his brother, Paul, had successfully completed his mission to create a private central bank within America.

1875 – 1914 was the greatest economic boom in world history; without a central bank, and with a hard-currency. Notwithstanding, the United States submitted to Paul Warburg, a man whose brother was advising the Kaiser on a war that had not yet begun. In Paul Warburg’s own words, the American industrial revolution was over because he declared that, “free and self-regulating markets are obsolete”.

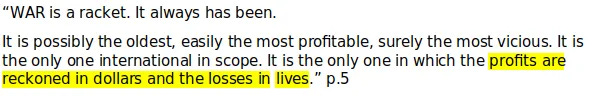

The Racket of War

In Hegel, War, the Owl and the Slaves of Bohemia we introduced the brilliant short-book by General Smedley Butler, War is a Racket:

https://truthtrench.org/?p=3656

General Butler was 100% on the money. His book brings the receipts; examining the financial statements and tax returns of American corporations and taxpayers. However, he did not have access to the accounts of globalist multinational corporations; the ones that were set up in London, Amsterdam, Frankfurt and Switzerland; the ones that used a matrix of subsidiaries, partnerships, patents and cross-border financing to extract the wealth from nations, and instantly transfer capital across the globe.

By the end of the Great War, staggering fortunes were amassed in America and throughout the world. The war would be a great opportunity to kickstart the “Progressive Era”:

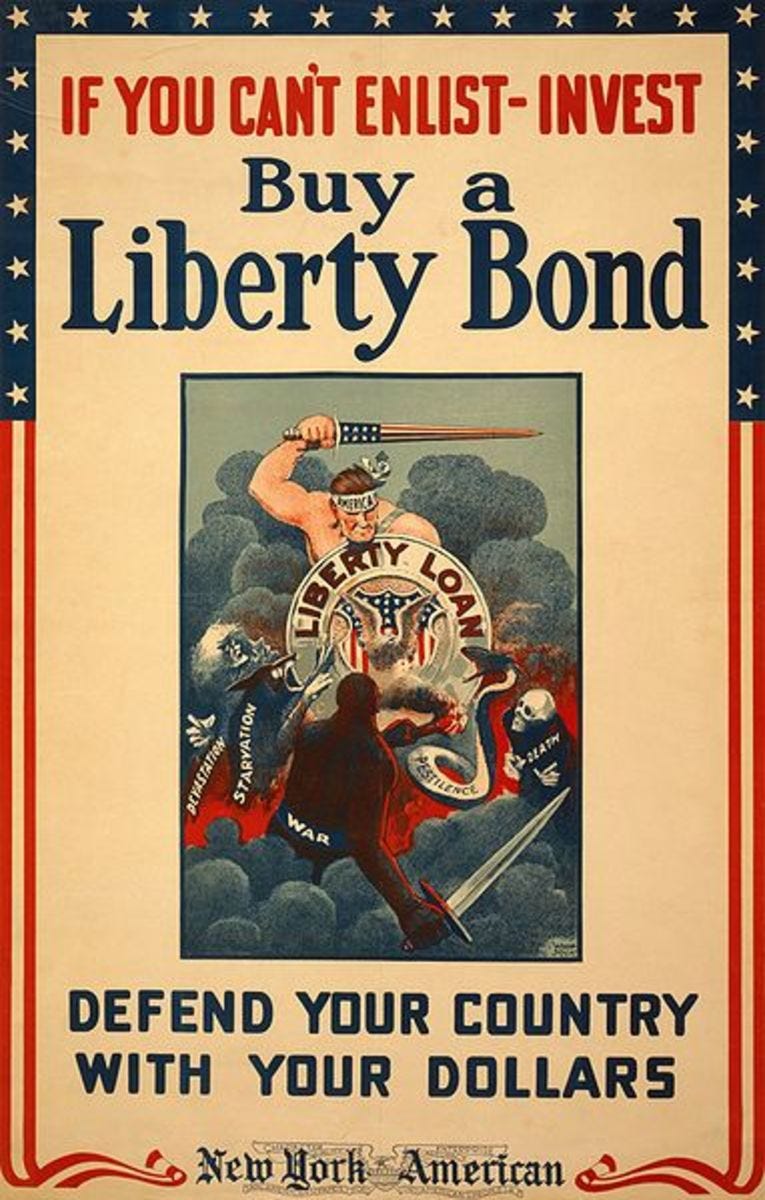

The War Industries Board was headed by famed stock market speculator, Bernard Baruch. Bernard was known as the “Lone Wolf of Wall St.”. His appointment by Woodrow Wilson allowed him to oversee the distribution of federal funds to companies that would provide the necessary war materiel for America. The declaration of war against Germany was going to cost money; lots of money. Congress authorized the issuance of Liberty Bonds, which Baruch invested millions of his own money into:

The money raised from Liberty Bonds, as well as other means of debt issuance, needed to be deposited and “banked”. The newly created Federal Reserve was now the banker for federal government deposits, and they readily accepted the monies raised from Liberty Bonds. Coincidentally, Paul Warburg was appointed Vice-Governor of the Federal Reserve during 1916 – 1918; instantly he became an expert in “war financing”:

The reality of 1917 was that Germany instigated America’s entry into the Great War. The United States government then raised an incredible amount of money, mainly from patriotic American citizens, in the form of Liberty Bonds and other debt instruments. This debt was deposited into the Federal Reserve, allowing for the creation of massive amounts of money and credit through the fractional reserve banking system that had just been set up by Warburg.

By the end of the war, the financial process that unfolded left Americans in more debt than ever before:

Americans were back where they started after the Civil War. However, this time around the federal government was not restricted to repaying its debts only via tariffs and excise taxes. In 1913 the 16th Amendment was ratified, which allowed income tax to be levied. General Butler explained the true outcome of the Great War best:

The World’s Most Successful Hedge Fund

In 1917, America was attacked like never before; not by a bomb, bullet, or an invasion; but by the machinations of international finance. When the 16th Amendment was ratified in 1913, it provided the framework for the federal government to service a debt level that was magnitudes greater than before. When the Federal Reserve Act was passed, it allowed for the creation of credit by the central bank through fractional reserve banking. The Federal Reserve became the banker for the federal government, and in order to expand credit, they needed lots of deposits. When America declared war on Germany, those deposits came in the form of Liberty Bonds.

By the conclusion of the Great War, the Prussia-controlled German Reich was sitting in a powerful position. The Reichsbank had doubled its gold reserves, paid for the Bolshevik revolution in Russia, and the American people were in debt up to their eyeballs, all overseen by a private bank structured by the Warburg family. No wonder Max Warburg advised the Kaiser in 1913 to be patient because “our enemies are getting weaker internally”.

The events leading up to 1917 were not swift or reactionary; they were slow and deliberate. It all began with the issuance of Civil War bonds, and a man who combined the skills of Otto von Bismarck’s Realpolitik with the ruthless money-lending operations from the City of London. This man was Gerson von Bleichroder, and his strategy was RealEconomik.

The partnership between Bleichroder and Bismarck is unprecedented. Bismarck’s access to tens of thousands of spies, all over the world, allowed for the infiltration of every aspect of an enemy’s infrastructure. Bismarck had the ability to pervert another nation’s government through blackmail, bribery and assassination. Bismarck was so competent in these endeavors, that even the head of the Prussian Gestapo was aghast at what Bismarck could achieve.

Imagine what financial wonders Bleichroder could achieve with access to this Bismarckian apparatus. Beginning with the investment in Civil War bonds, the Treaty of 1871 and international law based in Geneva, profits could be reinvested into multinational corporations. They received near-unlimited finance from the City of London, and were able to set up subsidiary companies in America to extract wealth during the industrial revolution; controlling American companies through patent royalties. Most importantly, they controlled the financial apparatus in Wall St thanks to German-American banks and big players like Otto Kahn; aka “The King of New York”.

When William of Orange conquered Britain, the bankers got the Bank of England. When Kuhn, Loeb & Co. was established in 1867, wave after wave of German bankers arrived to join them. Paul Warburg arrived at Kuhn, Loeb & Co as part of this wave, and the US Federal Reserve was established just over a decade later.

The dodgy origins of the US Federal Reserve is best described in G. Edward Griffin’s book, The Creature from Jekyll Island. However, the Federal Reserve was just one trophy in a long series of events which first began with Gerson von Bleichroder.

While Frederick the Great gave sanctuary to Jews that served his vision for Prussia, such as bankers Daniel Itzig and Moses Mendelssohn, Gerson von Bleichroder was the first Jew to receive a noble title in Prussia. This was most likely because of his service to the kingdom and his ability to bankroll the Reich, the Kaiser, and Otto von Bismarck. He was a loyal servant of Prussia.

Bleichroder’s ability to financially play both sides of a conflict meant that he was “hedging his bets”. When America and Britain signed the 1871 Treaty, both nations effectively exchanged their sovereign laws for an international court, overseen by the Kaiser. The Treaty ensured it was Bleichroder’s clients, who owned Civil War bonds, who truly came out on top.

Bleichroder’s legacy firm carried on operations well after he had passed away. The firm moved to New York in 1937, as Arnhold and S. Bleichroder. In 1963, they hired George Soros after he completed his masters at the London School of Economics. Bleichroder helped launch Soros’ first hedge fund, the Double Eagle, in 1969.

Since that time, we have been blessed by Soros’ activities in financial markets and beyond. He has been found guilty of insider trading alongside the late Robert Maxwell, father of Ghislaine Maxwell. He was famous for “breaking” the Bank of England, as well as forcing currency runs on numerous developing nations around the world. He was once introduced by Hillary Clinton as the man who will make “meaningful change” to American politics. In The ReichsWEF Part IV, we showed the involvement Soros has had with numerous color revolutions around the world, including Ukraine.

Today, Soros applies the same RealEconomik that Bleichroder developed over a century ago.

When we look at how America has evolved since the Treaty of Washington 1871, perhaps we should ask, what do Bleichroder, Mendelssohn, Warburg, Kuhn, Loeb, Schiff, Kahn, George Soros, and a host of others have in common? Do they all serve the horrible invisible enemy, Prussia?

To investigate these questions, we must bring this entire 1871 fiasco into the modern era.

To be continued……………….

https://nypost.com/2023/01/18/prostitutes-charge-davos-attendees-2500-a-night/

https://www.gutenberg.org/files/48823/48823-h/48823-h.htm#Page_161

https://www.gutenberg.org/files/48823/48823-h/48823-h.htm#Page_161 p 182

https://www.wordnik.com/words/catallactics

Wilkins, Mira. The History of Foreign Investment in the United States to 1914. Harvard , iversity Press, 2004. p 107,109

https://www.law.cornell.edu/constitution-conan/amendment-14/section-4/public-debt-clause

Wilkins, Mira. The History of Foreign Investment in the United States to 1914. Harvard , iversity Press, 2004. p 120

https://www.db.com/files/documents/Deutsche-Bank-History–Chronicle-from-1870-until-today.pdf

Wilkins, Mira. The History of Foreign Investment in the United States to 1914. Harvard , iversity Press, 2004. p 111

ibid, p 185

ibid, p 184

https://mises.org/library/transformation-american-economy-1865-1914

https://www.longtermtrends.net/us-debt-to-gdp/

Wilkins, Mira. The History of Foreign Investment in the United States to 1914. Harvard , iversity Press, 2004. p 145

ibid, p 165

ibid, p 161

ibid, p 156

ibid, p 170

https://allthatsinteresting.com/frederick-trump-donald-trump-grandfather

Wilkins, Mira. The History of Foreign Investment in the United States to 1914. Harvard , iversity Press, 2004. p 176

https://www.jstor.org/stable/pdf/1884932.pdf

https://prussiagate.substack.com/p/the-prussian-origins-of-the-us-federal

https://ia600906.us.archive.org/10/items/willynickycorres00bernuoft/willynickycorres00bernuoft.pdf

ibid, p 12

https://en.wikipedia.org/wiki/Black_Hand_(Serbia)

Rothbard, Murray N. A History of Money and Banking in the United States. Ludwig von Mises Institute, 2002. p 387, 391

https://www.youtube-nocookie.com/embed/YygQ0Wq0wDA?rel=0&autoplay=0&showinfo=0&enablejsapi=0

33:59, Feldman “The Great Disorder”

ibid, 36:17, Feldman “The Great Disorder”

https://mises.org/library/economics-inflation-study-currency-depreciation-post-war-germanyp 448.

https://www.jstor.org/stable/2639641?read-now=1&seq=2#page_scan_tab_contents

https://prussiagate.substack.com/p/hegel-war-the-owl-and-the-slaves

https://www.independent.org/publications/books/summary.asp?id=101

https://fraser.stlouisfed.org/files/docs/publications/wfca/cic_warburg191807.pdf